Checking Accounts Disclosure

Personal Checking Accounts

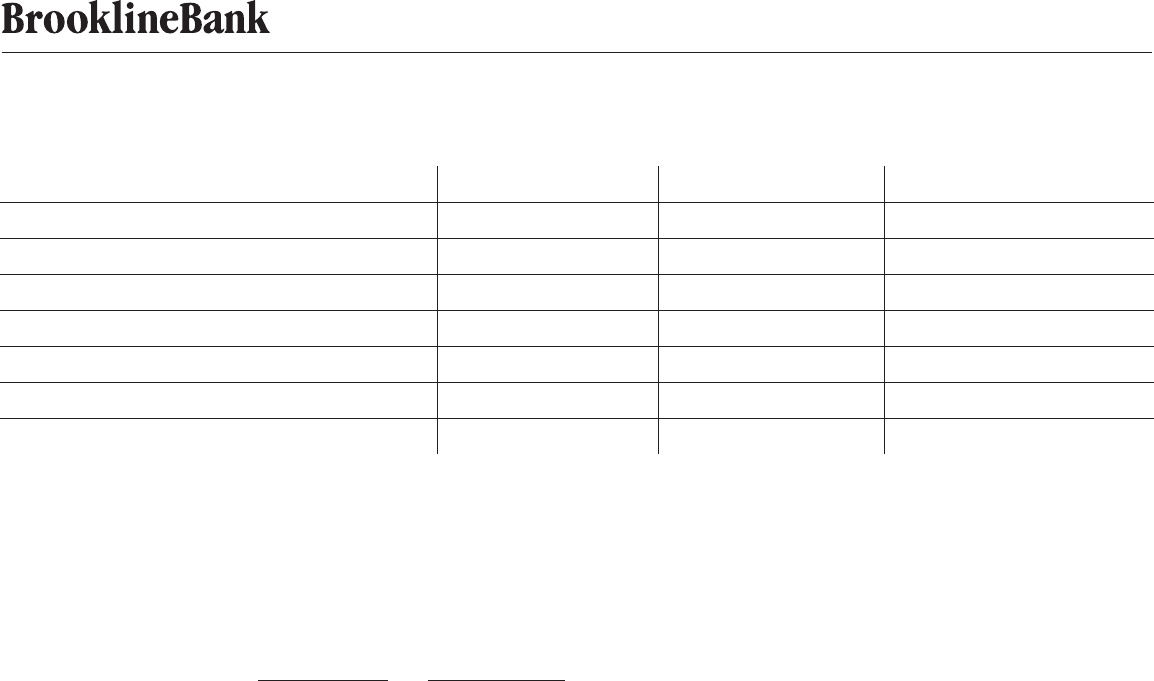

ACCESS

ONE Checking

1

ACCESS

PLUS Checking

PREMIER

ACCESS Checking

Minimum opening deposit $25 $100 $250

Monthly maintenance fee $0 $16.50 $35

Combined balance

2

to waive monthly maintenance fee N/A $5,000 or Direct Deposit $35,000

Minimum balance to earn interest N/A N/A $100

Non-Brookline Bank ATM withdrawal fee $2.50 None None

Surcharge-free access to thousands of SUM

®

program ATMs

3

Yes Yes Yes

Stop payments $30 $30 Waived

Interest Rate Information: The following interest rates and annual percentage yields (APYs) are accurate as of ________________. Rates are subject to change at any time at our discretion. No interest is paid on

ACCESS

ONE Checking or

ACCESS

P LUS Checking accounts. We may change balance requirements or fees at any time with proper notice to you. For current rate information, call 877-668-2265.

Please Note: Interest rates for accounts opened online will be disclosed in a separate document at the time of account opening.

Interest Rate: APY:

PREMIER

ACCESS Checking

Common Account Disclosures

The following disclosures apply to all types of accounts.

Business Day: The term “business day” refers to every day except Saturdays, Sundays, and federal holidays.

Accrual of Interest: Interest begins to accrue no later than the business day of your deposit.

Compounding and Crediting Frequency: Interest will be compounded monthly. Interest will be credited to your account every month on the statement date.

Account Closing and Interest: If you close your account before interest is credited, you will not receive the accrued interest.

Balance Computation Method: We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day.

Notice of Withdrawal: We reserve the right to require seven days’ notice in writing before each withdrawal from an interest-bearing account as defined by Regulation D.

Fees could reduce earnings on your account.

1. Also available as 18/65 Checking, with reduced/waived fees for customers ages 18 and under or 65 and over. Ask for details.

2. Combined balance is calculated by adding together: (a) the average daily balance of all your personal non-retirement savings, personal checking, and personal money market accounts since their last statement dates; (b) the current balance of all your personal

certificates of deposit and individual retirement accounts (IRA) accounts as of your personal checking account’s last statement date; and (c) the current outstanding principal balance of all your personal home equity lines/loans, personal overdraft lines of credit, personal

loans, and personal mortgages held by Brookline Bank as of your personal checking account’s last statement date. Auto loans obtained through a car dealership are not included.

3. Surcharges may be assessed by other financial institutions (that are not part of the SUM® program) for the use of their ATMs. All ATM surcharges incurred in the U.S.A. will be refunded on

PREMIER

ACCESS Checking accounts.

Continued on reverse side

Effective January 8, 2024

Personal Service Fees

Effective January 8, 2024

The following fees may be assessed on your account. Fees shown are for each transaction of the type shown, unless otherwise indicated:

PO Box 470469

Brookline, MA 02447-0469

BBM 6002 01/2024

Member FDIC

Equal Housing Lender

To request additional information about

Brookline Bank’s products and services, please visit

your local Brookline Bank oce,

call us at 877-668-2265, or visit us online at

BrooklineBank.com

Telephone Banking: 888-730-3554

Abandoned Property, per account or such lesser rate as may be set by law .........................................$65.00

ATM/Debit Cards:

Expedited Card Replacement Fee ..................................................................................................$65.00

International ATM Transactions:

Mastercard (M/C) Cross-Border Fee ................................................................2.79% of USD Amount

Mastercard (M/C) Currency Conversion Fee .....................................................0.21% of USD Amount

Non-Brookline Bank ATM Transaction

1,2

.......................................................................................... $2.50*

Replacement ATM/Debit Card Fee ................................................................................................ $12.00*

Canadian Foreign Draft – USD value less than $300.00 ........................................................................ $15.00

Canadian Foreign Draft – USD value $300.00 or more ............................................................................$5.00

Cashier’s Check

3

......................................................................................................................................$7.50*

Check Order (CHK Order)

4

................................................................................ prices vary depending on style

Collection Item Fee ............................................................................................................................... $30.00

Counter Checks, per page .......................................................................................................................$2.00

Early Account Closure, within 90 days of opening .................................................................................$25.00

FI Transfer Fee (External Transfer) ..........................................................................................................$2.50

Legal Process Fee (e.g., attachment, levy, or garnishment), per occurrence

or such lesser rate as may be set by law ......................................................................................$100.00

Money Order

3

......................................................................................................................................... $5.00*

Overdraft Fee:

Paid Item Fee – when we pay an overdraft item, once per item

5

.................................................. $35.00

Overdraft Line of Credit

6

Annual Fee.................................................................................................................................... $25.00*

Research

Research Fee, per hour ................................................................................................................. $30.00*

Copy Fee, per item or per page (copies of checks, transaction slips, money orders,

cashier’s checks, or deposited items) ..............................................................................................$5.00*

Duplicate or Interim Statement Fee................................................................................................ $5.00*

Statement Copy with Images Fee ....................................................................................................$7.50*

Subpoena Research, per hour ........................................................................................................ $75.00

Safe Deposit Box Rental Fees:

(Check availability of sizes with your Branch Representative.)

Safe Deposit Box Annual Fee

7

........................................................................................... varies by size†*

Safe Deposit Box Drilling Fee ....................................................................................................... $200.00

Late Fee ......................................................................................................................................... $15.00

Replacement Key Fee ....................................................................................................................$35.00

† Contents of safe deposit boxes are not FDIC or Bank insured. Boxes are located at most

branch locations, and available sizes may vary.

Stop Payment, all items including ACH and bill pay ............................................................................. $30.00*

Sweep Transaction Fee (overdraft protection transfer from a deposit account), per transfer

1,3

..............$7.50*

Wire Transfer Fees:

Domestic:

Incoming ................................................................................................................................ $15.00*

Outgoing ................................................................................................................................ $23.00*

International:

USD Incoming ......................................................................................................................... $15.00*

USD Outgoing ......................................................................................................................... $40.00*

Foreign Currency Incoming........................................................................................................$0.00

Foreign Currency Outgoing ..................................................................................................... $25.00*

Wire Trace Fee ...............................................................................................................................$30.00

*This service is free for

PREMIER

ACCESS Checking accounts.

See footnotes below for details on fee waivers/refunds.

1. This fee is waived on

PREMIER

ACCESS Checking and

ACCESS

PLUS Checking accounts.

2. Other financial institutions (that are not part of the SUM® program) may impose a surcharge for ATM use. The surcharge will be refunded on

PREMIER

ACCESS Checking accounts.

3. This fee will be waived for customers ages 18 and under or 65 and over, if the customer notifies Brookline Bank of their eligibility.

4. Standard checks are free for

PREMIER

ACCESS Checking and 18/65 Checking accounts.

ACCESS

PLUS Checking accounts receive first order free.

5. You will be charged a Paid Item Fee if we honor or pay the item or transaction when you have a non-sufficient available balance. You will not be charged more than one (1) Overdraft Fee per item. We have no obligation to notify you if we honor, pay, return, or decline

an item or transaction for a non-sufficient available balance. This fee will be reduced to $5 for customers ages 18 and under or 65 and over, if the customer notifies Brookline Bank of their eligibility.

6. Refer to the Overdraft Line of Credit Agreement for more details.

7. A free safe deposit box is limited to one free box of any size (subject to availability) per

PREMIER

ACCESS Checking account.