1

OCABR

The Office of Consumer Affairs and Business Regulation

mass.gov/dob

2022

ANNUAL REPORT

Massachusetts

Division of

Banks

Table of Contents

Accomplishments ............................................................................................................................ 3

2022 Division of Banks (Division) Year in Review ........................................................................... 5

Annual Enforcement ..................................................................................................................... 12

Agency Strategic Goals ................................................................................................................. 15

Non-Depository Institution Supervision ......................................................................................... 16

Mortgage Supervision ........................................................................................................ 17

Consumer Finance/Money Services Business Activity ....................................................... 17

Depository Institution Supervision ................................................................................................. 20

Bank Summary: Balance Sheet and Income Statement .................................................... 21

Credit Union Summary: Balance Sheet and Income Statement ......................................... 24

Consumer Protection and Outreach .............................................................................................. 27

Consumer Assistance and Enforcement and Investigation ............................................................ 28

Foreclosure Prevention Grant Initiative ......................................................................................... 29

Community Reinvestment Act ....................................................................................................... 30

Cyber/IT/Fintech ........................................................................................................................... 31

Legal Unit ...................................................................................................................................... 32

Major Depository Corporate Transactions ......................................................................... 33

Legislative Summary ......................................................................................................... 36

Regulations ....................................................................................................................... 38

Regulatory Bulletins ........................................................................................................... 39

Banks, Credit Unions, and Licensees: ...................................................................................... 39

Banks and Credit Unions: .......................................................................................................... 39

Credit Unions: ............................................................................................................................. 40

Staff List ........................................................................................................................................ 42

Appendix I: Cooperative Banks ..................................................................................................... 43

Appendix II: Savings Banks........................................................................................................... 80

Appendix III: Limited Purpose Trust Companies .......................................................................... 156

Appendix IV: Trust Companies .................................................................................................... 159

This annual report has been developed in accordance with

Massachusetts General Laws chapter 167, §13.

2

As we look back on the year 2022, I recall the concluding sentence from this

very report a year ago: “emerging economic and ongoing industry pressures

including inflation, emerging technologies, cybersecurity risks are likely to

dominate regulatory conversations and examinations for the foreseeable

future; at present the Division and our regulated entities remain well positioned

and well managed for the challenges ahead.” In an environment where

competition and margins were already compressed, the financial industry and

consumers at large faced rising interest rates to levels last seen before the

2008 global financial crisis on back of the Federal Reserve aggressive

monetary policy tightening cycle. While economists and analysts will debate the

pace, speed, and peak of the rate environment, I am happy to report that the

strength of the financial industry operating is Massachusetts indeed reflects that

our regulated entities remain well positioned and well managed.

This annual report highlights that the Division’s body of work in 2022 is notably

accomplished, but we note that our supervision efforts and the vigilance of the

industry remain paramount to face certain challenges looming ahead. As we

entered the early months of 2023 facing economic uncertainty and recessionary

pressures, the U.S. banking industry reckoned with the harsh reality of three

large bank failures. Post-action and post-mortem reports underscore the

importance of fundamental risk management principles, and we at the Division

have been trumpeting this message as a reminder to all our regulated entities.

Technology and social media have introduced new considerations for the

speed of a liquidity event—boards and management teams that adapt while

adhering to safety & soundness principles will be best positioned.

The high-profile bank failures in early 2023 are a reminder that financial

regulatory agencies, including the Division of Banks, play an important

oversight role and must be sufficiently and adequately resourced. The Division

anticipated the evolving risks of large bank supervision, emerging technologies,

evolving financial industry, etc., and had the foresight to request additional

resources. The Division is anticipating an increase in our FY24 budget

appropriation which is currently pending in conference. As the Division of Banks

assesses the industry we regulate to cover our full operating costs, we want to

communicate to our regulated entities the importance of the additional funding

which will further enhance staffing resources as we strive to meet our mission

of ensuring a ensure a sound, competitive, and accessible financial services

environment throughout the Commonwealth.

While the Division continues to actively monitor economic pressures on the

banking industry, ensuring our examination work remains focused in the areas

of risk management and consumer protection compliance, we also are devoting

attention to the continued growth of products and services offered by non-bank

entities in the mortgage, consumer finance, and money service businesses. As

a reminder, these areas are not regulated by any federal body—the supervision

is done by the state banking departments around the country. We at the

Division are active participants with our fellow-state counterparts to leverage

resources in the area of non-bank supervision. Effectively, our “networked

supervision” effort looks to unify state financial regulators to conduct licensing

and examination work for large companies operating nationwide. We have

been doing this successfully for several years in the mortgage space, and we

are increasingly collaborating in the area of money

transmission. Unfortunately, Massachusetts money transmission authority is

significantly outdated compared with the rest of the country, such that we are

limited in our ability to participate in networked supervision efforts, and worse,

we are limited in our ability to afford Massachusetts residents with adequate

consumer protections for the common activity of peer-to-peer payments on

popular mobile apps. The Division continues to support legislation to modernize

Massachusetts money transmission statute (H.1106) which is consistent with a

model law already enacted in many states, and we remain hopeful for passage

in the 193

rd

General Court!

Letter from

Commissioner

Gallagher

Sincerely,

Mary L. Gallagher

Commissioner

Division of Banks

2022 ANNUAL REPORT

3

Licenses issued or renewed by the Division to

mortgage companies, mortgage loan originators,

money services businesses, debt collectors, loan

servicers, and consumer finance companies.

Total number of completed bank, credit union,

licensee, and other approval requests (655) and

total number of legal opinions (7) issued.

Total number of examination reports mailed to

depository (76) & non-depository (283)

institutions.

Foreclosure delay requests received by the

Division, of which 76 were granted.

Consumers receiving reimbursements totaling

$2.8 million from complaint resolution or Division

enforcement actions.

Accomplishments

20,087

662

359

113

37,828

MASSACHUSETTS DIVISION OF BANKS

4

Formal & informal regulatory orders issued by the

Division.

The Division's Legal Unit processed 51 bank and credit

union branch office notices/applications in 2022.

The Division hosted 4 webcasts on its DOB connects

platform. Topics included compliance concerns and

perspectives, cannabis and regulatory considerations,

and general financial matters.

Total number of major corporate transactions

consummated involving banks & credit unions.

Division employees achieved a total of 5 new

certifications in 2022 and completed, on average, 40

hours of training.

In 2022, the Division filled 13 positions including 3

management positions, 8 Bank Examiners, 1 Licensing

Examiner, and 1 Office Support Specialist.

61

5

4

13

16

5

1

2022 ANNUAL REPORT

5

2022 Division of Banks

(Division) Year in Review

First Quarter

January

In January, the 2022 Chapter 206 Grant Program application review process began with

21 staff members on 4 teams. A total of 24 grant applications were reviewed.

On January 3, the Division entered into multiple Consent Orders against Mortgage Loan

Originators Chad Baker, Michael Rakeman, and Kevin Heckemeyer related to a multi-

state action over violations of SAFE Act education requirements.

On January 4, the Division issued a Temporary Cease and Desist Order against Mutual

of Omaha, Inc. for alleged unfair or deceptive advertising practices.

On January 10, the Division entered into a Consent Order with First American National, LLC,

First American Funding, LLC, B&B Funding, LLC, and Coastal Financial, LLC to resolve

allegations of engaging in the business of a debt collector without the requisite license.

On January 18, the Division of Banks, in partnership with 44 state financial agencies,

reached settlements with more than 400 mortgage loan originators nationwide who

deceptively claimed to have completed annual continuing education for the Secure and

Fair Enforcement for Mortgage Licensing Act (SAFE Act) as required under state and

federal law.

February

In February, the Joint Financial Services Committee favorably reported the Domestic Money

Transmission bill as House 4550. The Financial Services Committee also favorably reported

House 1167 regarding uniform enforcement and confidentiality provisions.

On February 2, the Division entered into a Settlement Agreement and Consent Order with

Danny Yen d/b/a Real Estate Educational Services, Wendy Yen, and Dat Yen a/k/a Pat Yen

to cease involvement in education courses related to a multi-state action for MLO licensure

schemes.

A DOB connects program was held on February 3, titled “Home Mortgage Disclosure Act

(HMDA): Top Regulatory Finds and Best Practices”. The webcast featured conversations with

Division examiners from both the depository and non-depository units who discussed top

HMDA examination findings and best practices for HMDA compliance. The webcast can be

accessed here and the handout can be found here.

On February 7, the Division entered into a Consent Order with Mutual of Omaha Mortgage,

Inc. to resolve allegations of alleged unfair or deceptive advertising practices. This consent order

supersedes and replaces the 1/4/2022 Temporary Cease and Desist Order.

On February 8, Consumer Protection Examiners Sales and Williams participated in a

panel discussion on HMDA and examination trends at the MA Mortgage Bankers

Association (MMBA) meeting.

On February 16, Deputy Commissioner of Community Protection and Outreach Rivera

participated in a panel discussion on non-sufficient funds fees at the MA Bankers

Association (MBA) CEO Roundtable on Representment Practices and Non-Sufficient

Funds Fees.

MASSACHUSETTS DIVISION OF BANKS

6

On February 22, Counsel Carbone participated in a panel discussion on Mortgage

Business Specific Requirements in the Modernized NMLS at the annual NMLS Training

and Conference.

On February 23, the Division of Banks, the State Treasurer’s Office of Economic

Empowerment, and the Office of Consumer Affairs and Business Regulation announced

the opening of the application process for the 2022 round of Operation Money Wise

grants.

On February 23, Director Chase participated in a panel discussion on Nonbank

Cybersecurity: The Latest Threats and Regulatory Responses at the annual NMLS

Training and Conference.

The Division released the 2021 Annual Enforcement Report.

March

On March 2, the Division issued Opinion 21-009 relative to licensing requirements for digital

currency trading and custody services and certain liquidity services.

On March 4, the Division approved Needham Bank’s purchase of cannabis-related

business and money service business customers of Eastern Bank.

On March 7, the Division issued a follow up Industry Letter to provide guidance to mortgage

servicers as consumers exit pandemic-related forbearances.

On March 9, the Division entered into a Consent Order with Cross Country Mortgage, LLC to

resolve allegations of alleged unfair or deceptive advertising practices. This consent order

supersedes and replaces the 11/30/2021 Temporary Cease and Desist Order.

On March 9, the Division entered into a Settlement Agreement with Andrew Marquis to

resolve allegations of alleged unfair or deceptive advertising practices. This consent order

supersedes and replaces the 11/30/2021 Temporary Cease and Desist Order.

On March 15, the Division of Banks awarded over $2.5 million in grants to 24 organizations

in support of first-time homeownership education programs and foreclosure prevention

counseling centers throughout the Commonwealth through the Chapter 206 grant

program.

On March 16, The Division held a public hearing on proposed amendments to 209 CMR

42.00: The Licensing of Mortgage Lenders and Mortgage Brokers.

On March 24, IT/Cyber/Fintech Examiner Whitten provided a cybersecurity update at the

New England Adjustment Managers Association (NEAMA) annual seminar.

On March 25, the Division approved the merger of Revere Municipal Employees

Federal Credit Union (Revere Municipal) into St. Jean’s Credit Union.

On March 25, Chief Director Weydt spoke on current hot topics in the consumer

protection space, including general DOB examination practices in a remote

environment, representment, CRA qualified CD activity, and recent compliance areas

with violations at the Eastern Massachusetts Compliance Forum.

On March 25, the Division issued an Industry Letter to provide guidance and clarification of

the Division’s policy as it relates to the evaluation of licensees’ financial responsibility as part

of the Massachusetts annual license renewal process.

On March 30, Director Chase moderated the “Cross-Communication and Collaboration during

a Significant Cybersecurity Event” session at the CRMWG TTX meeting.

2022 ANNUAL REPORT

7

Second Quarter

April

On April 12, the Division issued Opinion 21-005 regarding the charging of a convenience

fee for over the phone payment.

On April 12, the Division issued an Industry Letter as a reminder to licensees regarding

the submission of annual financial statements.

On April 14, Deputy Commissioner Cuff and Examiner Papalegis volunteered at the

Credit for Life Fair held at Andover High School.

On April 25, the Division issued Opinion 21-008 regarding the licensing requirements to

provide cash management services to Bitcoin ATM operators.

On April 26, Director Chase was a panelist on an IT and cybersecurity panel at the CSBS

2022 Spring Summit.

On April 26, the 2022-2023 Financial Education Innovation Fund Grant application period

commenced. Grants provided through this program support the Credit for Life fairs hosted

by MA high schools.

On April 27, Commissioner Gallagher, General Counsel Keefe, Senior Deputy

Commissioner Bienvenu, and Chief Director Morrison spoke at the Cooperative Credit

Union Association’s “A Dialogue with the MA Division of Banks” event.

May

On May 3, DOB connects hosted the 2022: Compliance Priorities: Concerns and

Perspectives from the Financial Industry. The webcast featured a discussion with two

compliance officers from Massachusetts banks on various issues including the impact of the

war in Ukraine on business banking, post pandemic operations and staffing, cannabis

business, and fintech. The recording can be accessed here and the handout can be found

here.

On May 5, Chief Director O’Driscoll, Field Operations Manager Vaidya, and Examiner Fitzgerald

volunteered at the Credit for Life Fair held at Holbrook Senior-Junior High school.

On May 6, Manager Vaidya volunteered at the Credit for Life Fair held at Medford High

School.

On May 6, Personnel Coordinator Buzzell volunteered at the Credit for Life Fair held at

Abington High School.

On May 9, the Division published the final amendments to 209 CMR 42.00: The Licensing of

Mortgage Lenders and Mortgage Brokers – Final, which became effective on 5/27/22.

On May 18, the Division approved the merger of Premier Source Federal Credit Union

into Polish National Credit Union.

On May 27, the Division, along with the Office of Economic Empowerment (OEE) and the

Office of Consumer Affairs and Business Regulation (OCABR), announced the recipients of

the 2022 Operation Money Wise: Financial Opportunity Grant awards. This grant opportunity

provides funding for financial education programs created for the Massachusetts Military,

Veteran, Family, and Survivor Community (MVFSC). A total of $43,900 was awarded to

9 organizations.

MASSACHUSETTS DIVISION OF BANKS

8

June

On June 1, Director Chase presented on the IT Exam Program at the CSBS Nonbank

Baseline & Enhanced WorkProgram Update.

On June 9, the Division held the Annual Training Symposium. Over 125 employees attended

the training, which included economic updates and a panel on Cybersecurity.

On June 10, Examiner Agyemang along with Undersecretary Palleschi volunteered at

the Credit for Life Fair held at Randolph High School.

On June 15, 2022, DOB connects hosted “Cannabis and BSA: Banking Perspectives and

Regulatory Considerations”. The webcast featured a discussion with Regional Field

Manager Reyes and DIS Manager Cook, and a senior vice president and compliance officer

from a Massachusetts community bank. The discussion focused on cannabis banking and

legislation, highlighting the 2021 SAFE Act. The recording can be accessed here.

On June 22, the Division issued Opinion 21-006 regarding the licensing requirements

for the financing of time share interests.

On June 27, the Division approved the merger of Holyoke Postal Credit Union into

Holyoke Credit Union.

On June 28, Division issued the 2022 Deposit Return Item Fee Decision, establishing the

maximum allowable fee Massachusetts state-chartered banks and credit unions may

assess certain consumer deposit accounts for processing dishonored checks.

On June 29, Division staff attended the Fraud Prevention and Awareness training

presented by the MA Office of the Comptroller.

The Division of Banks published the 2021 Annual Report of the Commissioner of Banks.

The report encapsulates agency achievements and provides a snapshot of the financial

industry regulated by the Division.

In June, the DOB completed the new laptop deployment, upgrading all staff laptops.

On June 30

th

, in coordination with HEDIT and external consultants, the DOB concluded

the RMS cross-browser remediation project.

2022 ANNUAL REPORT

9

Third Quarter

July

On July 26, the Division hosted DOB connects: A Discussion About Fair Banking and

Verifying Compliance with Regulation E, highlighting specific considerations around

unfair banking and general compliance management considerations relevant to deposit

accounts.

On July 26, the Division issued a decision relative to the Merger of Patriot Community Bank,

Woburn, Massachusetts with and into East Cambridge Savings Bank, Cambridge,

Massachusetts.

August

On August 10, Deputy Commissioner Cuff participated in a panel discussion on Hot

Topics in Licensing at the AARMR Conference.

On August 19, the Division issued Opinion 22-001 on licensing or registration requirements

for servicing a branded credit card issued by a bank.

September

On September 8, Chief Director Weydt and Examiners Dempsey and Dimunah

presented along with the FDIC on Common Violations and UDAP representment

reviews at the Western Mass Compliance Conference.

During the month of September, Diversity Officer Rivera planned a special Hispanic

Heritage Month virtual event to commemorate Hispanic and Latina leaders in

Massachusetts. A September 19

th

event featured an in-depth interview with Dr.

Vanessa Calderon-Rosado, who has led her organization to be the largest Latino-led

nonprofit organization in the Greater Boston area.

On September 22, 2022, the Division hosted a virtual public Board of Bank Incorporation

Hearing pertaining to a petition by Brookline Bancorp, Inc. of Boston, MA to acquire PCSB

Financial Corporation of Yorktown Heights, NY, the holding company for PCSB Bank of

Brewster, NY.

On September 26, the Division issued a decision relative to the Merger of Envision Bank,

Randolph, Massachusetts with and into Abington Bank, Abington, Massachusetts.

On September 27, the Division issued a decision relative to the Merger of Northmark

Bank, North Andover, Massachusetts with and into Cambridge Trust Company,

Cambridge, Massachusetts.

On September 27, during Boston Fintech Week, the Division of Banks hosted Meet the

Regulators: Connecting the Commonwealth’s Financial Regulator with the Fintech

Community. Division presenters included Deputy Commissioner Desai, Chief Director

O’Driscoll, Licensing Examiner Bullock, First Deputy Commissioenr Begin, and Comissioner

Gallagher. More than 60 industry leaders, entrepreneurs, and interested parties attended the

session held at Worcester Polytechnic Institute (WPI) Seaport.

MASSACHUSETTS DIVISION OF BANKS

10

Fourth Quarter

October

In October, the DOB celebrated National Disability Employment Awareness by sharing with

all staff resources, expanding recruitment initiatives, and encouraging participation in

training opportunities. On October 5, the Division coordinated a staff training with the MA

Office on Disability (MOD)’s Executive Director Mary Mahon McCauley, and General

Counsel Julia O’Leary to highlight important considerations as we think of “Disability in the

Workplace”.

On October 4, Chief Director Weydt participated in a panel discussion on Unfair and

Deceptive Acts and Practices (UDAP) and Representment at the FFIEC Consumer

Compliance Conference.

On October 5, sixteen examiners received promotions to the next examiner level: 6 to

Examiner II, 3 to Examiner III, and 7 to Examiner IV.

On October 7, the Division issued a Regulatory Bulletin Update pertaining to updates

to examination policy, branch office policies, guidelines for “18-65” accounts, and credit

union membership by-laws.

On October 11, Division issued a Cease Directive to Julie’s Check Cashing pertaining

to unlicensed check cashing activities.

On October 11, Division issued a Cease Directive to Master Cut Meat Market, LLC

pertaining to unlicensed check cashing activities.

On October 11, Division issued a Cease Directive to Brasileirinho Market, Inc. d/b/a

Emporium Brasileirinho pertaining to unlicensed check cashing activities.

On October 12, Deputy Commissioner Cipolla volunteered at the Credit for Life Fair

held at Whitman-Hanson Regional High School.

On October 31, the Board of Bank Incorporation issued a decision relative to the

Application of Brookline Bancorp, Inc., Boston, Massachusetts to acquire PCSB

Financial Corporation, Yorktown Heights, New York.

In recognition of National Cybersecurity Awareness Month in October, the Division issued a

cybersecurity awareness bulletin for consumers: #SeeYourselfInCyber. Each week during

the month, the Division posted information pertaining to cybersecurity:

Multi-factor authentication (MFA)

Use strong passwords

Recognize and report Phishing

Update your software

2022 ANNUAL REPORT

11

November

On November 1, the Division issued Opinion 22-002 relative to licensing requirements

for a platform to purchase virtual currency for fiat or sell virtual currency for fiat.

On November 3, the Division issued a Cease Directive to Full Circle Financial Services, LLC pertaining

to unlicensed debt collection activities.

On November 15, through our employee-led resource group (ERG), the VIEW, DOB held a staff

introspective session titled, Is Workplace “Ambition” a Thing of the Past? to discuss how career

fatigue and other life pressures can often impact women more than their male counterparts.

On November 17, Regional Field Manager Reyes participated in a panel discussion on Bank Secrecy

Act/Anti-Money Laundering (BSA/AML) trends and issues at the Mass Bankers Association BSA/AML

Workshop.

On November 21, the DOB relaunched the Mentor Program, holding the kick-off meeting with 24

volunteer participants.

On November 28, the Division issued a decision relative to the Merger of Foxboro Federal Savings, Foxboro,

Massachusetts with and into Norwood Co-operative Bank, Norwood, Massachusetts.

On November 29, Deputy Commissioner Barrett participated on the bank regulatory

panel at the Mass Bankers Association Financial Institutions Financial Conference.

On November 29, the Division held the semi-annual training symposium for Division Staff with Tom

Siems, CSBS Chief Economist, as the keynote speaker.

December

On December 14, Chief Director Morrison participated in a panel discussion at the annual meeting of

the Association of Credit Union Senior Officers.

On December 30, the Division entered into a Consent Order with loanDepot.com, LLC to resolve

allegations of unregistered third-party loan servicing activities.

In December, the Division prepared for the January roll-out of the new online annual

reporting process for the ATM Schedule Qs and non-depository annual reports.

MASSACHUSETTS DIVISION OF BANKS

12

Annual Enforcement

In 2022, the Division issued a total of 61 formal and informal regulatory Enforcement Orders which included 18

formal public orders listed below. The Division collected a total of $1,412,000.00 in administrative penalties and

reimbursed $2,836,483.96 to a total of 37,828 consumers.

Mortgage Companies

loanDepot.com, LLC Consent Order

Kind Lending, LLC Consent Order

Andrew Marquis Settlement Agreement

Cross Country Mortgage, LLC Consent Order

Mutual of Omaha Mortgage, Inc. Consent Order

Mutual of Omaha Mortgage, Inc. Temporary Cease and Desist Order

Mortgage Loan Originators

Danny Yen d/b/a Real Estate Educational Services, Wendy Yen, and Dat Yen

a/k/a Pat Yen

Settlement Agreement

Brian Brown Consent Order

Kevin Heckemeyer Consent Order

Michael Rakeman Consent Order

Chad Baker Consent Order

Check Cashers

Julie’s Check Cashing Cease Directive

Master Cut Meat Market, LLC Cease Directive

Brasileirinho Market, Inc. d/b/a Emporium Brasileirinho Cease Directive

Debt Collectors

Full Circle Financial Services, LLC Cease Directive

Penn Credit Corporation Consent Order

Monterey Financial Services, LLC Consent Order

First American National, LLC & First American Funding, LLC & B&B Funding,

LLC & Coastal Financial, LLC

Consent Order

2022 ANNUAL REPORT

13

Key Agency Actions

The Division produced four DOB connects webcasts during 2022. Topics included cannabis banking,

compliance issues and trends, and the Home Mortgage Disclosure Act (HMDA). All webcast recordings can

be found here.

Home Mortgage Disclosure Act (HMDA): Top Regulatory Finds and Best Practices on

February 3, 2022.

2022 Compliance Priorities: Concerns and Perspectives from the Financial Industry on

May 3, 2022.

Cannabis and BSA: Banking Perspectives and Regulatory Considerations on June 15,

2022.

A Discussion About Fair Banking and Verifying Compliance with Regulation E on July

26, 2022. here.

As reported in the 2022 Annual Enforcement Bulletin, the Division collected a total of $1,412,000.00 in

administrative penalties and reimbursed $2,836,483.96 to a total of 37,828 consumers.

The Division continued to expand recruitment collaborations and participated in more than 10 different

virtual and in-person recruitment opportunities including, but not limited to, virtual reverse job fairs

sponsored by the MA Human Resources Division in coordination with the Massachusetts Commission

for the Blind and Massachusetts Rehabilitation Commission, opportunities with MassHire at regional

virtual job fairs, and recruitment associated with various local colleges and universities.

Division staff continued to take advantage of new virtual training opportunities with 17 participants joining

FFIEC virtual conferences, 12 examiners completing core FDIC requirements, and 36 participants in

regulatory association conferences, 54 participants in regulatory and compliance programs, and 11

participants in skill building classes.

In January, the Division of Banks, in partnership with 44 state financial agencies, reached settlements

with more than 400 mortgage loan originators nationwide who deceptively claimed to have completed

annual continuing education for the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE

Act) as required under state and federal law. You can read the full details here.

On March 7, 2022, the Division published an Industry Letter to provide guidance to mortgage servicers

as consumers exit pandemic-related forbearances.

On March 15, 2022, the Division of Banks awarded over $2.5 million in grants to fund first-time

homeownership education programs and foreclosure prevention counseling centers throughout the

Commonwealth. The funds awarded through the Chapter 206 grant program went to a total of 24

organizations including 9 regional foreclosure prevention centers and 15 consumer counseling

organizations.

On May 27, 2022, the Division of Banks, Treasurer Goldberg’s Office of Economic Empowerment, and

the Office of Consumer Affairs and Business Regulation (OCABR) awarded over $43,000 in grants to

nine organizations to establish new or improve pre-existing financial education programs for the

Military, Veteran, Family, and Survivor Community. You can read more about these organizations and

the grants here.

Starting in September, the Division embraced a hybrid examination posture, conducting in-person

meetings, visitations, and on-site reviews as appropriate.

On September 22, 2022, the Division hosted a virtual public Board of Bank Incorporation Hearing

pertaining to a petition by Brookline Bancorp, Inc. of Boston, MA to acquire PCSB Financial Corporation

of Yorktown Heights, NY, the holding company for PCSB Bank of Brewster, NY.

MASSACHUSETTS DIVISION OF BANKS

14

On September 27, 2022, during Boston Fintech Week, the Division of Banks hosted Meet the

Regulators: Connecting the Commonwealth’s Financial Regulator with the Fintech Community. More

than 60 industry leaders, entrepreneurs, and interested parties attended the session held at Worcester

Polytechnic Institute (WPI) Seaport.

On October 7, 2022, the Division issued a Regulatory Bulletin Update pertaining to updates to

examination policy, branch office policies, guidelines for “18-65” accounts, and credit union

membership by-laws.

On November 23, 2022, the Division issued a Regulatory Bulletin Update pertaining to updates to

counseling and opt-in requirements for subprime adjustable rate mortgage loans made to first time

home loan borrowers.

On December 1, 2022, the Division of Banks, in partnership with the Massachusetts Office of Consumer

Affairs and Business Regulation and State Treasurer’s Office of Economic Empowerment, announced

the recipients of the Financial Education Innovation Fund Grant for the 2022-2023 academic year.

Thirty-nine Massachusetts high schools, including 8 first-time applicants, were awarded $115,400 for

Credit for Life Fairs. This year’s round saw a 300% increase in special education school applicants.

Throughout 2022, Division staff volunteered at 8 Credit for Life Fairs at high schools across the

Commonwealth.

2022 ANNUAL REPORT

15

Agency Strategic Goals

The Division’s 2021-2023 Strategic Plan reflects the agency’s commitment to the mission of ensuring a sound, competitive, and

accessible financial services environment throughout the Commonwealth. The Plan focuses on our agency’s vision and core

values, as reflected and strived for in the daily work of Division staff.

We support a culture of inclusion within the Commonwealth that values and promotes diversity and equal opportunity for all

individuals. We align agency diversity and inclusion initiatives with EOHED’s Diversity Plan and goal to build robust,

sustainable, and measurable diversity, equity, and inclusion initiatives across the agencies.

Throughout the year, agency staff made significant steps in working to achieve our vision of a financial services environment in

which:

the public has confidence in its financial institutions;

consumers have the information needed to make wise financial choices; and

financial institutions can compete both within the Massachusetts system and with federally chartered

entities.

We worked towards our mission and vision by focusing on the following goals:

Supervision and Regulatory Environment

Effectively supervise and examine the Division’s regulated entities through a regulatory framework which ensures consumer

protection while promoting a competitive industry. The Division will strive to develop and maintain a real-time, networked

supervision program utilizing data to satisfactorily complete its core supervisory functions through examination, licensing,

consumer complaint review and response, and initiation of regulatory actions where appropriate. Key objectives are:

real-time supervision

data analytics

networked supervision

climate risk

legislative priorities and legal guidance; and,

innovation in financial services.

Consumer Protection and Outreach

Implement and enforce consumer protection laws and regulations while providing consumers and/or industry with

information to make informed financial decisions and be prepared to mitigate anticipated risks. Key objectives are:

consumer protection leveraging expanded data analytics and established processes; and,

outreach building on the Division’s platform for disseminating agency messages and topics of interest.

Administration, Staffing and Development

Review and plan for operational improvements to ensure the Division functions effectively and efficiently amidst the

changing workplace landscape. Strive to develop the Workforce of Tomorrow by leveraging collaborations, technology, and

maximizing partnerships. Key objectives are:

technology and administration

pandemic response and preparedness; and,

workforce development.

MASSACHUSETTS DIVISION OF BANKS

16

Non-Depository Institution

Supervision

The Non-Depository Institution Supervision (NDIS) unit licenses and examines the over 20,000 non-depository financial

institutions in Massachusetts. These institutions include:

Mortgage lenders

Mortgage brokers

Consumer finance companies

Money services businesses

Debt collectors

Loan servicers

Check Cashers

Check Sellers

Student Loan Servicers

To evaluate the overall safety and soundness of the non-depository financial institutions in Massachusetts, and to comply

with our mission to ensure sound, competitive, and accessible financial services, NDIS examiners conduct periodic

examinations of these companies to assess the level of compliance with consumer protection laws and determine if the

licensee is operating in a safe and sound manner.

2022 ANNUAL REPORT

17

Mortgage Supervision

The Division’s Mortgage Exam Unit (MEU) continued to improve its exam procedures in an effort to increase efficiency

and effectiveness. The MEU also continues to participate in coordinated exams with other states through the Multi-State

Mortgage Committee (MMC) as well as targeted and full-scoped examinations that utilize the State Examination System

(SES) through Networked Supervision, One Company One Examination and other innovative and coordinated strategies.

The MEU continues its proficiency in the examination of

complex loan servicers and debt collectors. In doing so,

the MEU is well versed in and regularly takes advantage

of the Nationwide Multistate Licensing System and

Registry (NMLS), including the analytics and mortgage

call reporting functions, resulting in efficient risk scoping

during the pre-exam phase of the examination. In support

of the MEU’s overall risk assessment, key risk indicators

are regularly evaluated to ensure appropriate strategic,

operational, financial, and compliance tolerances. The

MEU continues to engage in cyber-security training in

order to be better prepared for ever-increasing global

cyber threats. The MEU has adopted the CSBS

Cybersecurity work-program to greater assist in that

overall preparedness.

In 2022, the Division’s Licensing Unit continued to process a high volume of Non-Depository license applications. Mortgage

Broker and Mortgage Lender applications submitted by sole proprietors and startups increased, and business plans

submitted by Non-Depository institutions continue to evolve and presented complex business models that many times

triggered the requirement for multiple licensees. Non-Depository institutions engaged in the Small Loan and Third Party

Loan Servicer businesses continued to increase as fintech applicants in the marketplace expand. The Licensing Unit

regularly evaluates the overall state of the Massachusetts economy and the ever-changing markets while evaluating all

Non-Depository applications which include twelve distinct licenses and registrations spanning from Mortgage Lenders,

Mortgage Brokers and Student loan servicers to Foreign Transmittal Agencies and Motor Vehicle Sales Finance Companies.

The figures include regulatory action and approved licensee information occurring within the Division during 2022.

CRA requirements are in place for certain mortgage lenders in accordance with M.G.L. c. 255E, § 8. These provisions

require a CRA evaluation of mortgage lenders that have originated 50 or more Home Mortgage Disclosure Act (HMDA)

reportable mortgage loans in the previous two calendar years.

The Division conducted 20 CRA examinations of mortgage lenders during 2022. There are currently 91 Public Evaluations

of mortgage lenders posted on the Division’s website.

Consumer Finance/Money Services Business

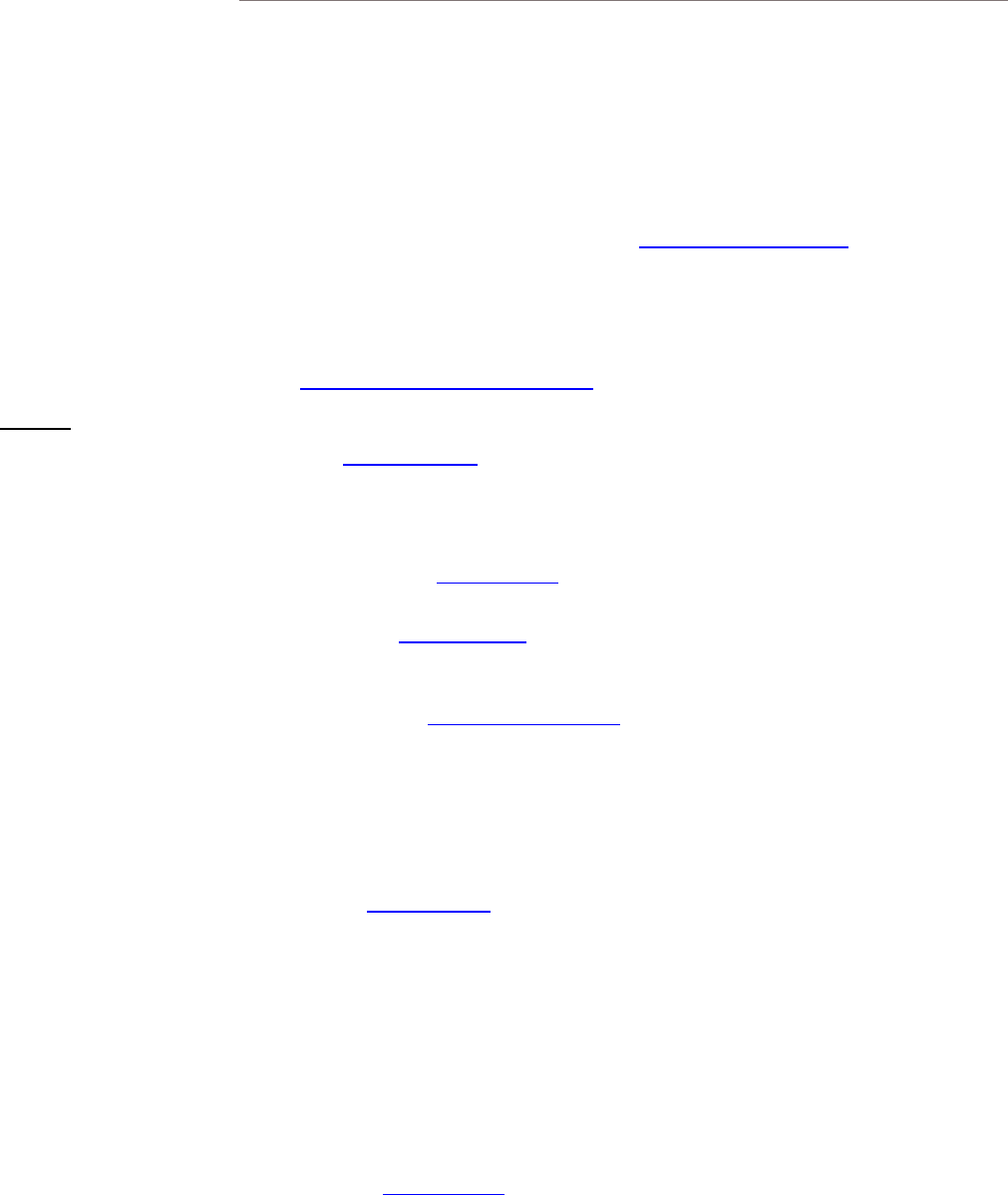

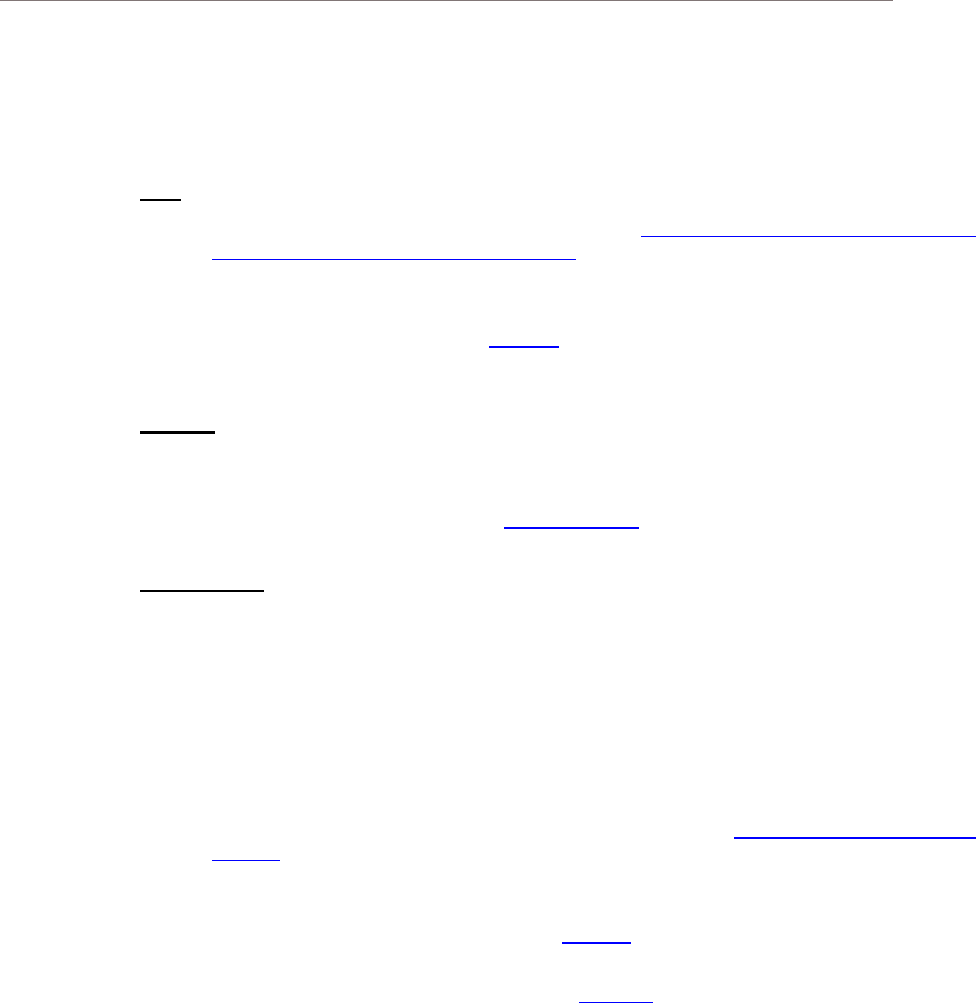

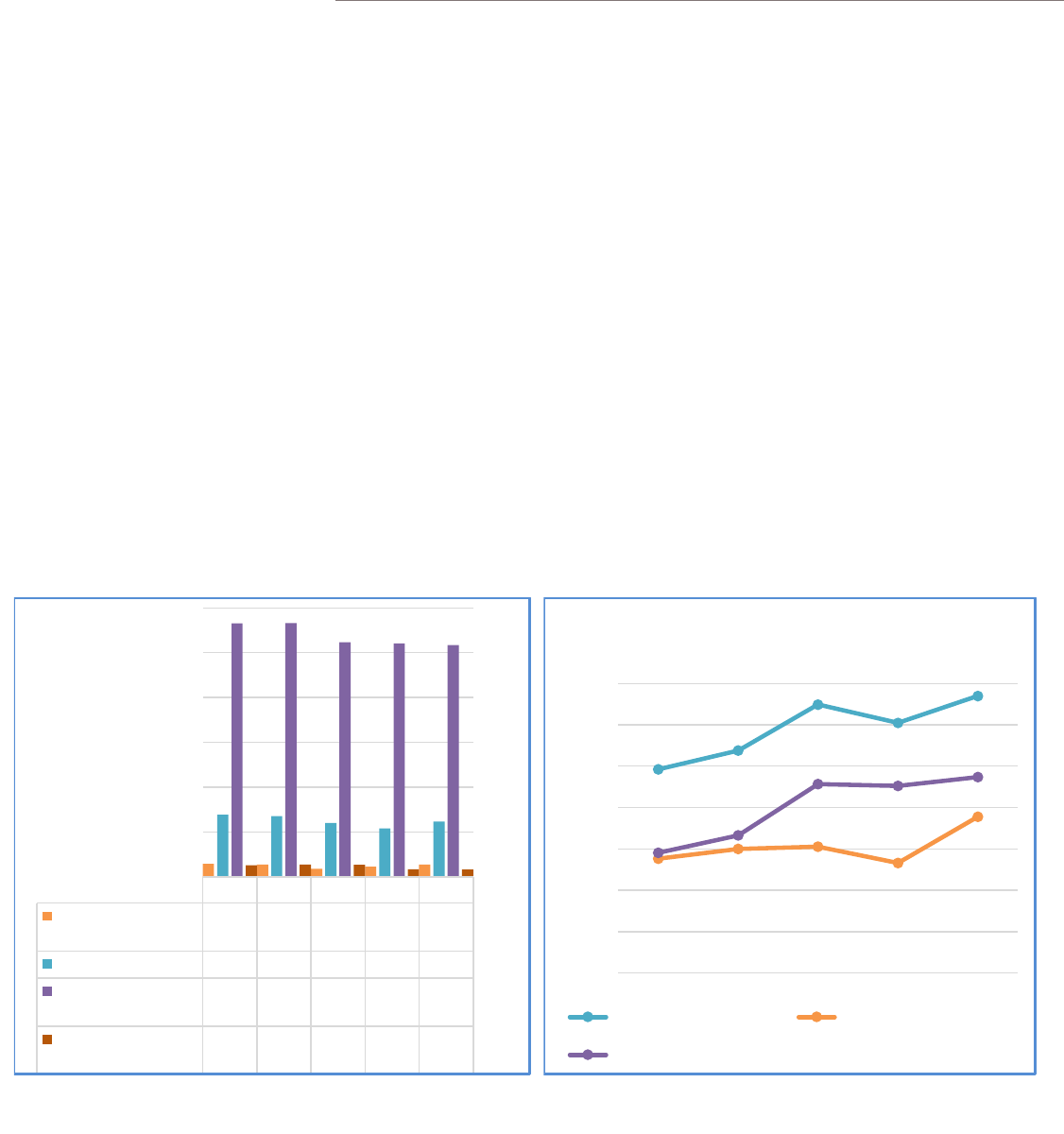

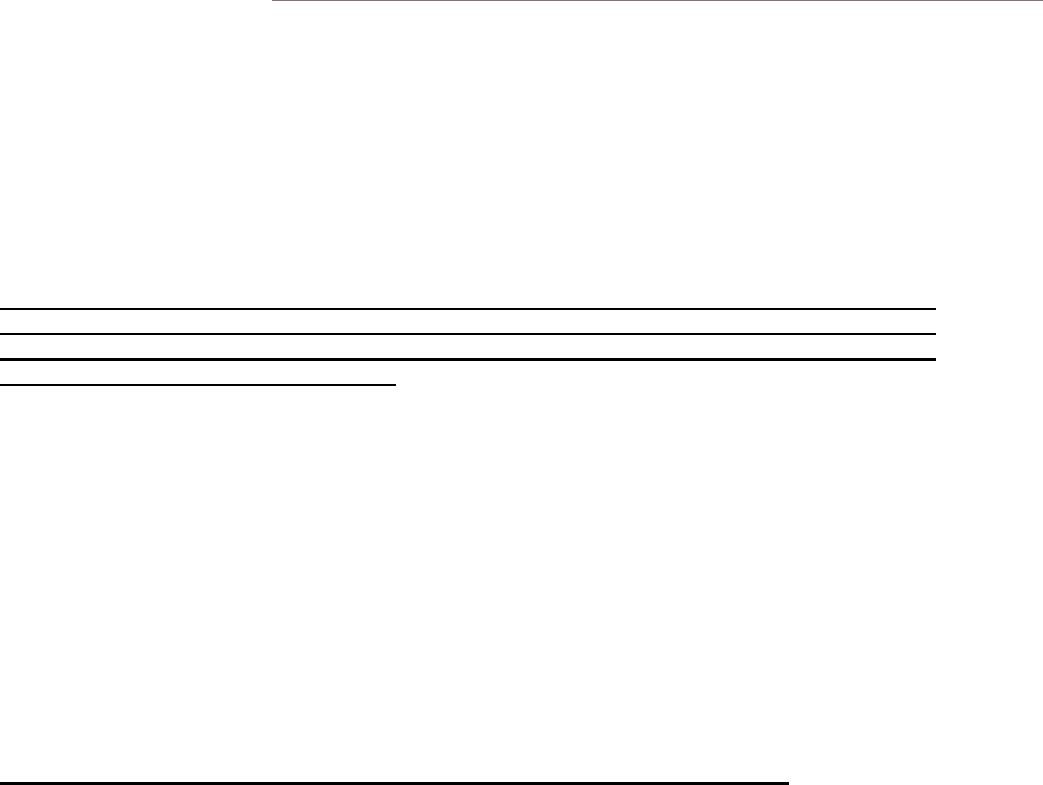

9936

10,107

9017

11,351

15,080

9,729

Approved Mortgage Loan

Originators by Year End

2017 2018 2019 2020 2021 2022

15

19

15

14

7

2 2

5

0

10

20

2019 2020 2021 2022

Regulatory Actions Taken by the

Division Against Brokers & Lenders

Informal Formal

15

19

15

14

7

2 2

5

0

10

20

2019 2020 2021 2022

Regulatory Actions Taken by the

Division Against Brokers & Lenders

Informal Formal

MASSACHUSETTS DIVISION OF BANKS

18

Activity

In 2022, the Consumer Finance/Money Services Business Unit’s many accomplishments helped promote the Division’s ’

mission of ensuring a sound, competitive, and accessible financial services environment throughout the Commonwealth.

Over $2.2 million was reimbursed to over 30,000 Massachusetts consumers during 2022 as a

result of examinations conducted on licensed finance companies and debt collectors.

The Division maintains membership in regulatory trade groups to aid in the supervision of

regulated entities, including the National Association of Consumer Credit Administrators

(NACCA), the North American Collection Agency Regulatory Association (NACARA), and the

Money Transmitters Regulatory Association (MTRA).

The Division actively participates on boards and committees for these trade groups. Senior

Deputy Commissioner Christopher Pope sits on the MTRA Board and Deputy Commissioner

Andrea Cipolla serves on NACCA’s Emerging Issues Committee. Division staff also serve on

the NACARA Regulatory Supervision Committee, NACCA Auto Finance Committee, and the

NACCA/NACARA Student Loan Supervisory Taskforce Examinations sub-committee. Several

CF/MSB Unit staff members also participate on NMLS committees and working groups

focusing on Networked Supervision, Consumer Finance Call Reports, and Licensing

Standards. RFM Young and Examiner Cabarcas participated on an emerging issues panel at

the NACARA Annual Meeting in October.

The CF/MSB Unit completed 11 joint multi-state examinations in 2022. Nine joint examinations

were conducted with MTRA, and two were conducted with NACARA. Several other

examinations were in process in 2022, including coordinated examinations of large national

student loan servicers, and a joint multistate examination of a large national subprime auto

finance company. Massachusetts acted as the lead state for the joint auto finance examination

leading a team of 12 states.

The CF/MSB Unit commenced conducting examinations of student loan servicers. These

examinations included targeted examinations of certain low volume licensees to ensure a

timely and efficient review of servicing activity and coordinated multi-state examinations of two

high volume national student loan servicers.

The CF/MSB Unit coordinated with the Enforcement & Investigations Unit to investigate several

claims of unlicensed check cashing activity. These investigations led to the issuance of public

cease directives against three companies for unlicensed check cashing activity.

The CF/MSB Unit worked with the Licensing and Operations Units to convert annual report

forms for finance companies, debt collectors, loan servicers and money services businesses

to allow for online submission of annual transaction data.

The CF/MSB Unit has pursued training for examinations staff on cryptocurrency and blockchain

technology. The unit also researched and piloted the use of a blockchain analysis tool to

determine its applicability to and effectiveness for the supervision of licensees engaged in

cryptocurrency activity.

2022 ANNUAL REPORT

19

The CF/MSB Unit coordinated with the Division’s IT Unit to review recent data breach reports

on a regular basis and conduct outreach to licensees impacted by significant data breaches.

The Division entered into a Consent Order with a licensed debt collector to address alleged

servicing, collecting on, and purchasing purported lease agreements, most of which were used

to purchase dogs and other pets, which were in fact predatory retail installment sale

agreements with exorbitant finance charges originated by unlicensed entities. The Division

determined the company was collecting illegal fees and using unfair and unconscionable

means in servicing accounts. The company was required to issue $210,000 in direct

reimbursements to consumers and forgive more than $750,000 in accounts it owned, cease

servicing illegal accounts for other parties, and remove any negative credit reporting on the

illegal accounts.

MASSACHUSETTS DIVISION OF BANKS

20

Depository Institution Supervision

The main objective of the Depository Institution Supervision (DIS) unit is to evaluate the overall safety and soundness of

the depository financial institutions in Massachusetts in order to comply with the Division’s mission to “ensure a sound,

competitive, and accessible financial services environment throughout the Commonwealth.” This process includes an

assessment of each institution’s risk management systems, financial condition, and compliance with applicable banking

laws and regulations.

The DIS unit examiners and managers supervise the Commonwealth’s 142 state-chartered banks and credit unions and 2

limited purpose trust companies to ensure they comply with federal and state laws and regulations. As prescribed in MGL

c. 167, the DIS unit conducts examinations of these institutions for

Risk management (also known as safety and soundness)

Consumer protection compliance

Community Reinvestment Act (CRA) and Fair Lending.

Other responsibilities of the DIS unit include consumer outreach and education. The unit will issue guidance specific to

banks and credit unions on various topics and issues. The DOB connects program, featuring state and federal experts and

guest speakers, consists of periodic webinars and webcasts covering regulatory developments and consumer-related topics

for financial institutions and community organizations.

2022 ANNUAL REPORT

21

Bank Summary: Balance Sheet and Income

Statement

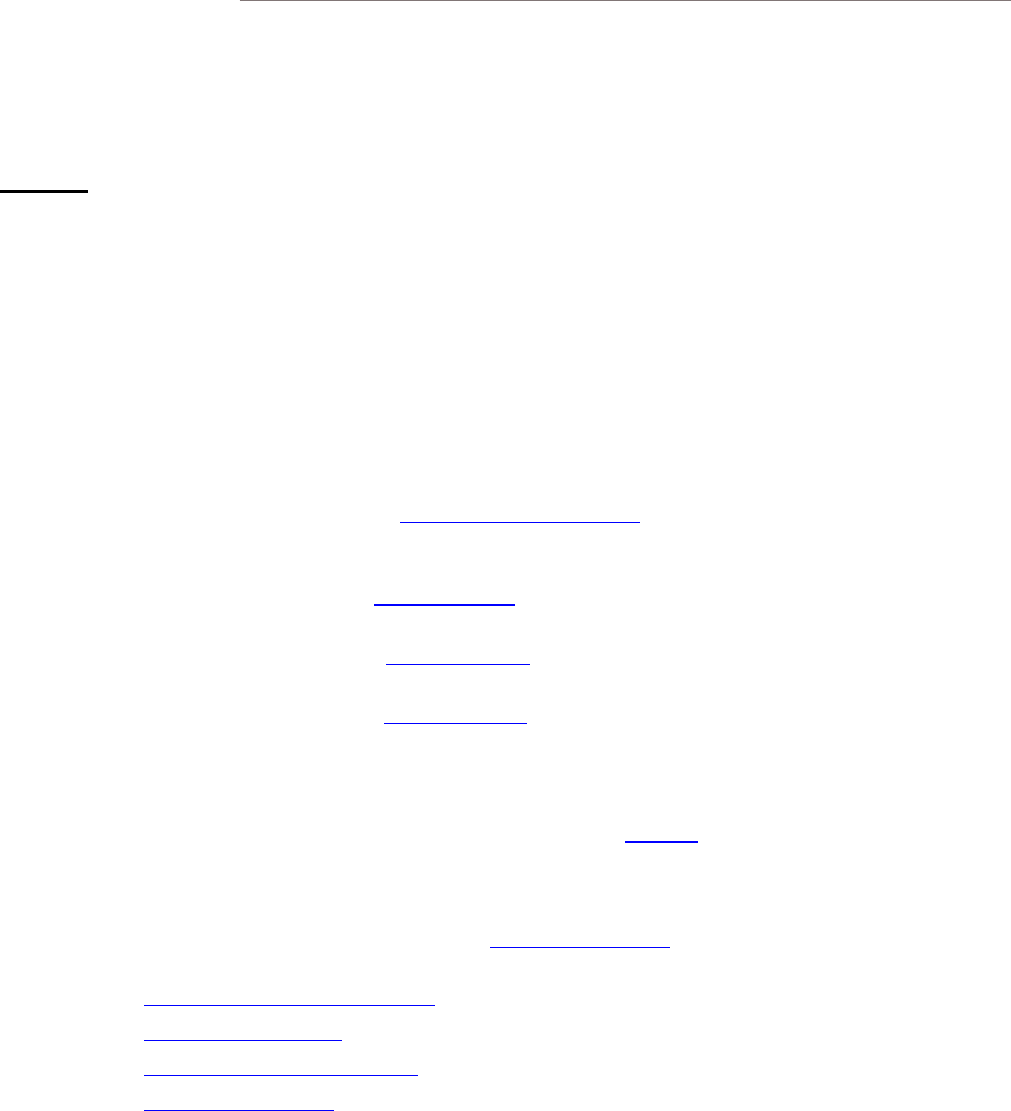

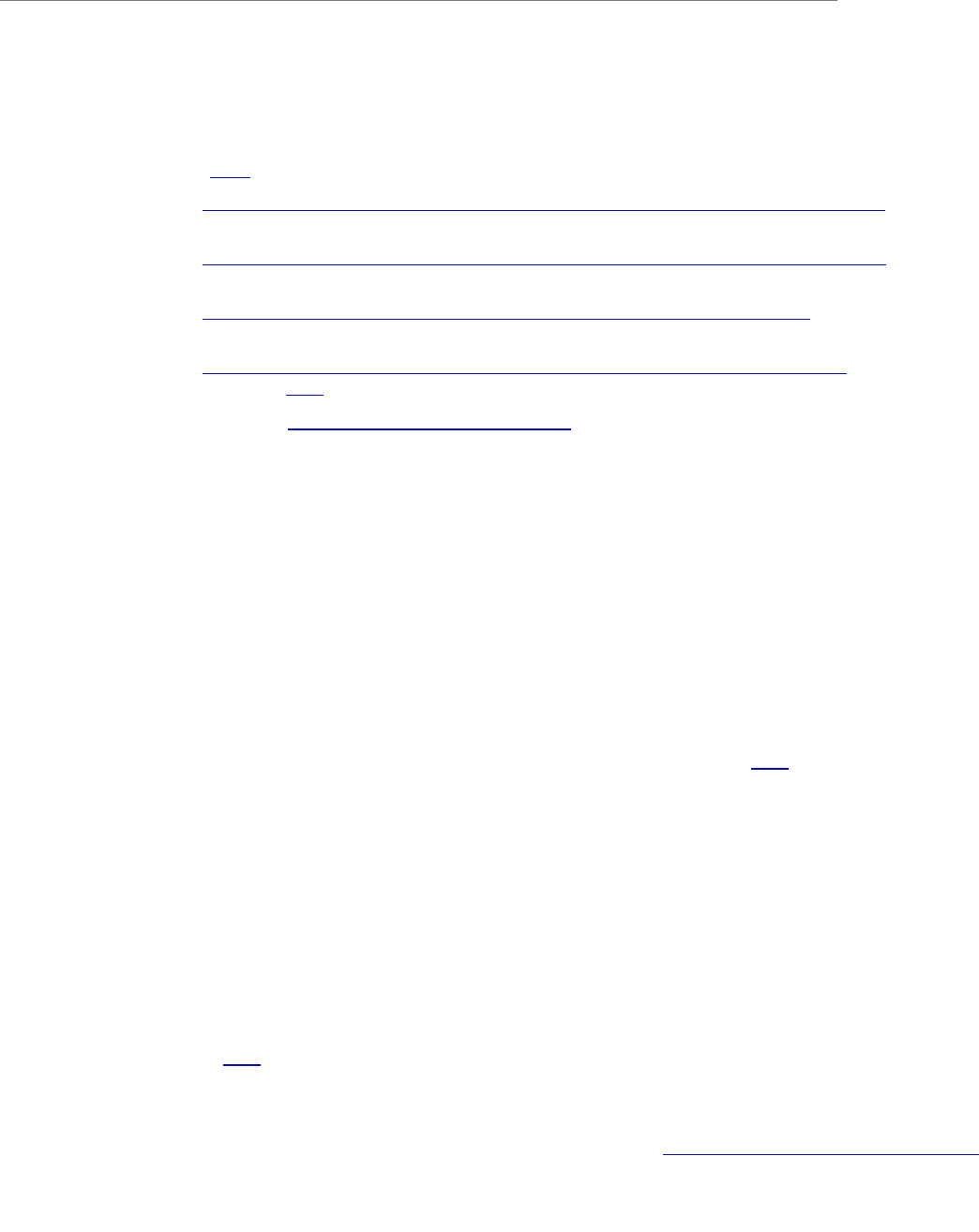

The calendar year 2022 was a year of change for Massachusetts state-chartered institutions and banks across the country

due to sharp interest rate increases. Massachusetts state-chartered bank assets marginally decreased year-over-year by

just over one percent. Substantial decreases in cash and securities holdings saw liquidity put to work in corresponding

increases in aggregate loan balances. Aggregate deposit runoff was modest, at -4% for the year, but that runoff, coupled

with loan demand, led to a sharp increase in the reliance on aggregate other borrowed funds to fill funding gaps, as that

figure increased by 146%, year-over-year. Moderate declines in equity capital resulted from adverse other comprehensive

income figures due to unrealized losses in bank security portfolios.

One tailwind from increasing interest rates was an increase in net interest income. While there were sharp increases in

both interest income and

interest expense of 52%

and 476%, respectively,

this led to interest income

increasing by 31%, year-

over-year. The provision

for credit losses saw a

significant uptick of 1,152%

despite low charge-offs

and delinquencies. As

expected, securities losses

adversely impacted net

income over the year due

to equity market

performance. However,

despite some of these

impediments, aggregate

net income was up 8%,

year-over-year.

As we all know, since year-

end 2022, the banking

landscape has shifted even

more, with several regional

bank failures necessitating

the shoring up of on-

balance sheet and

secondary liquidity

sources. This abundance

of caution will likely lead to

decreased earnings for

early 2023, if not

throughout the year.

Despite this, the labor

market remains strong,

and loan demand, as well

as delinquency and

charge-off figures for

Massachusetts state-

charters, reflect this

strength. While no

economic fault lines are

currently visible, banks

must remain vigilant

throughout 2023 regarding

their liquidity needs, the

tapering of interest rate

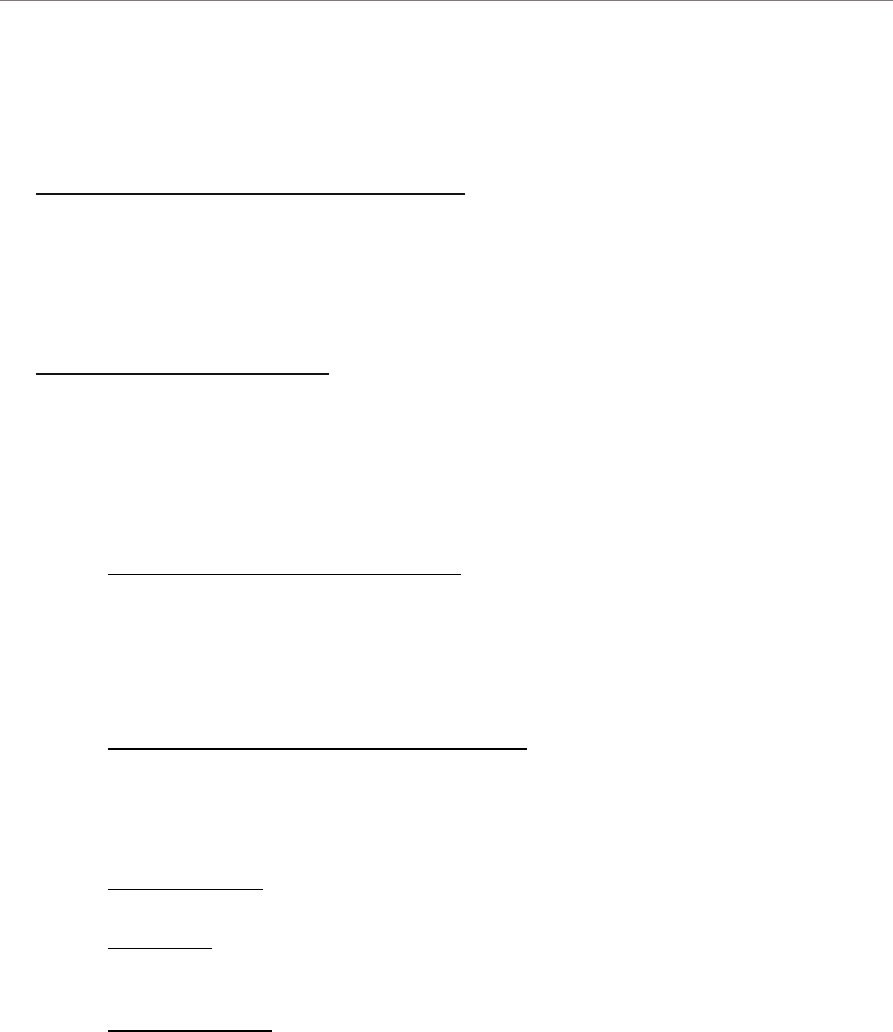

2.36

0.95

0.06

8.95

1.81

0.7

0.09

8.24

1.61

0.9

0.05

8.21

1.98

0.89

0.06

8.33

0 1 2 3 4 5 6 7 8 9 10

NIM

ROA

Net Charge-Offs / Total Loans

Tier 1 Leverage Ratio

Aggregate Massachusetts Bank Financial

Ratios

2019-2022

2022 2021 2020 2019

$404,202,426

$151,135,643

$317,455,546

$44,588,758

$495,053,253

$158,677,726

$398,822,021

$46,864,820

$495,497,612

$155,609,500

$417,282,807

$49,268,861

$490,291,493

$173,062,972

$399,651,852

$46,467,317

$0 $100,000,000$200,000,000$300,000,000$400,000,000$500,000,000$600,000,000

Total Assets

Net Loans & Leases

Total Deposits

Total Equity Capital

Aggregate Massachusetts Bank Balance

Sheet Data 2019-2022

2022 2021 2020 2019

MASSACHUSETTS DIVISION OF BANKS

22

increases and their effect on earnings and balance sheets, and the headwinds associated with a cooling economy.

Bank Balance Sheet

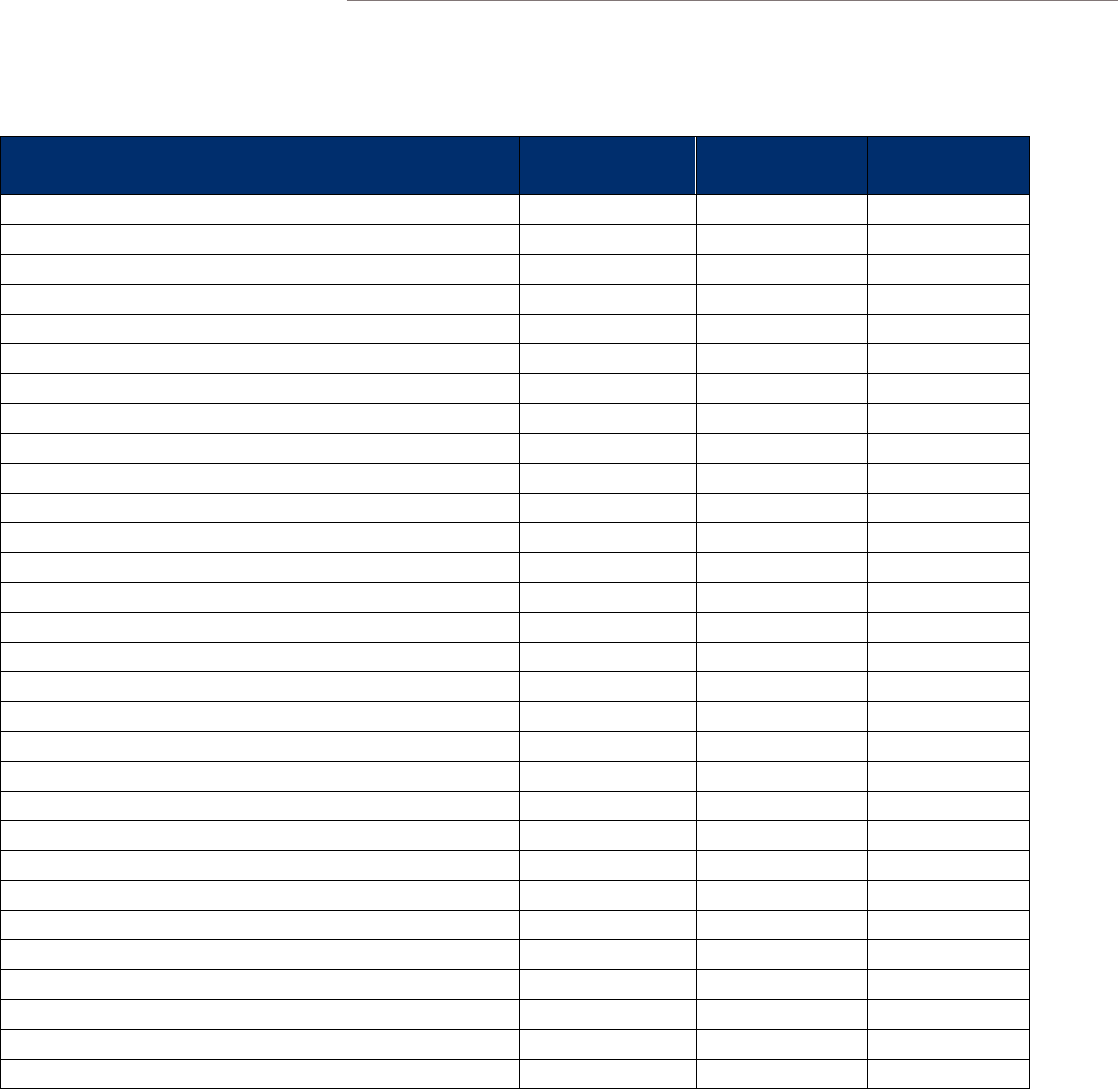

Years Ending December 31 2021 2022 % Change

$ in 000s

$ in 000s

Cash & Balances due from depository institutions

125,581,804

110,676,309

-12%

Total securities

150,322,358

138,577,966

-8%

Federal funds sold and reverse repurchase

3,229,950

5,286,252

64%

Gross Loans and Leases

157,052,931

174,603,074

11%

Loan loss allowance

1,429,956

1,540,102

8%

Net loans and leases

155,622,975

173,062,972

11%

Trading account assets

4,584,600

8,108,102

77%

Bank premises and fixed assets

4,256,974

4,372,022

3%

Other real estate owned

1,593

1,309

-18%

Goodwill and other intangibles

11,483,875

11,204,719

-2%

All other assets

40,219,085

39,001,842

-3%

Total assets

495,303,214

490,291,493

-

1%

Total deposits

417,253,488

399,651,852

-4%

Federal funds purchased and repurchase agreements

2,210,070

1,697,145

-23%

Trading liabilities

5,596,924

7,841,316

40%

Other borrowed funds

6,560,465

16,126,749

146%

Subordinated debt

1,566,000

1,547,000

-1%

All other liabilities

13,004,174

16,960,114

30%

Total Liabilities

446,191,121

443,824,176

-

1%

Perpetual preferred stock

26,861

19,796

-26%

Common stock

84,960

83,921

-1%

Surplus

25,116,041

25,545,921

2%

Undivided profits

23,876,810

20,810,554

-13%

Equity, minor interest in consolidated subs

7,421

7,125

-4%

Total equity capital

49,112,093

46,467,317

-

5%

Total Liabilities and Equity Capital

495,303,214

490,291,493

-

1%

2022 ANNUAL REPORT

23

Bank Income Statement

Years Ending December 31 2021 2022 % Change

$ in 000s

$ in 000s

Total interest income

6,706,087

10,285,787

53%

Total interest expense

331,294

1,908,564

476%

Net interest income

6,374,793

8,377,223

31%

Provision for loan and lease losses

16,803

210,388

1152%

Gross Fiduciary activities income

7,177,984

6,543,497

-9%

Service charges on deposit accounts

161,216

192,110

19%

Trading account gains and fees

893,280

929,847

4%

Additional Noninterest Income

3,068,040

2,887,481

-6%

Total noninterest income

11,300,520

10,552,935

-7%

Salaries and employee benefits

6,560,593

6,707,904

2%

Premises and equipment expense

2,324,115

2,338,907

1%

Additional noninterest expense

3,616,497

3,728,525

3%

Total noninterest expense

12,501,205

12,775,336

2%

Pre-tax net operating income

5,157,305

5,944,434

15%

Securities gains (losses)

307,784

(190,973)

-162%

Applicable income taxes

1,179,219

1,130,134

-4%

Income before extraordinary items

4,285,870

4,623,327

8%

Extraordinary items, net

(9,317)

-

-100%

Net income

4,276,553

4,623,327

8%

MASSACHUSETTS DIVISION OF BANKS

24

Credit Union Summary: Balance Sheet and Income

Statement

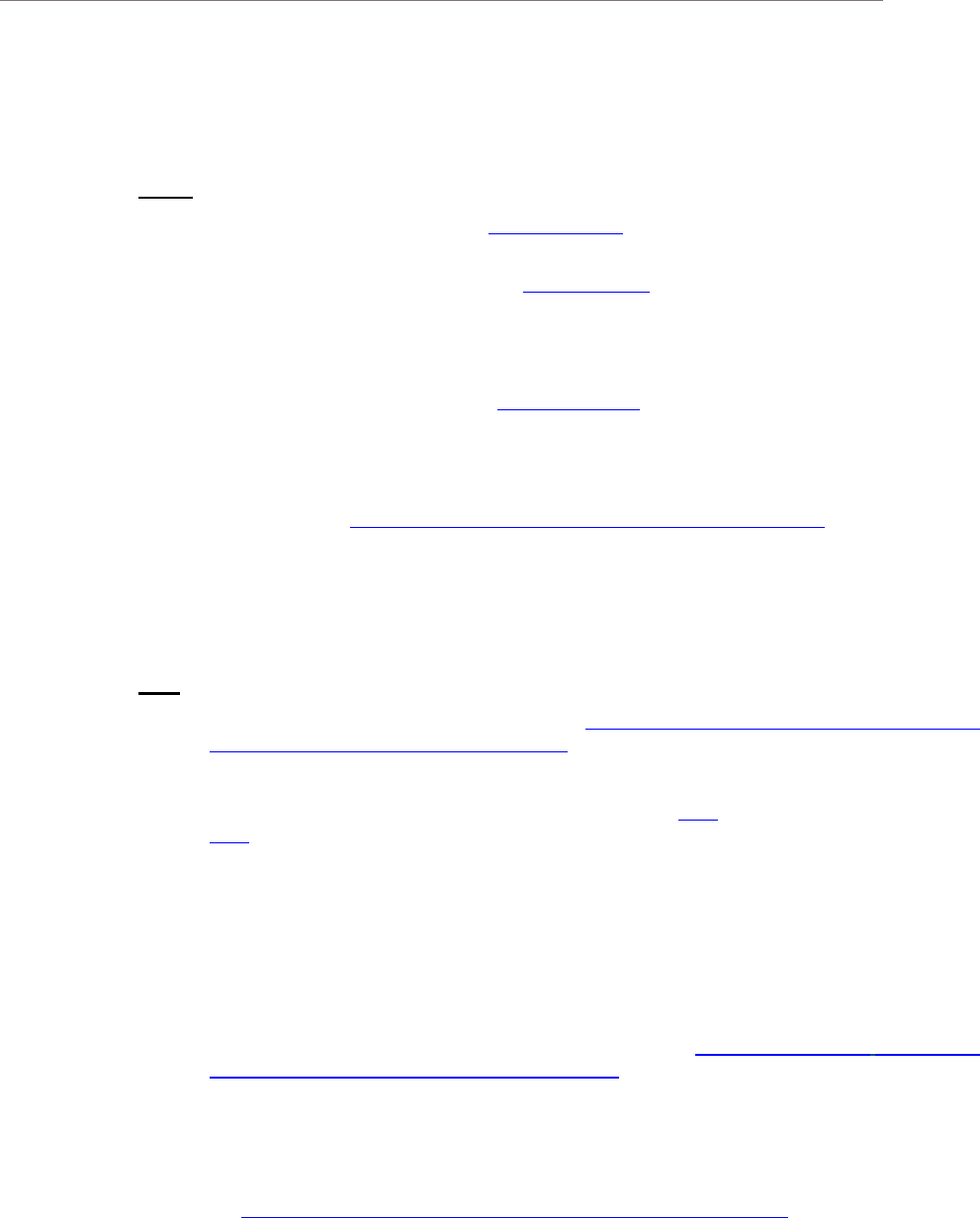

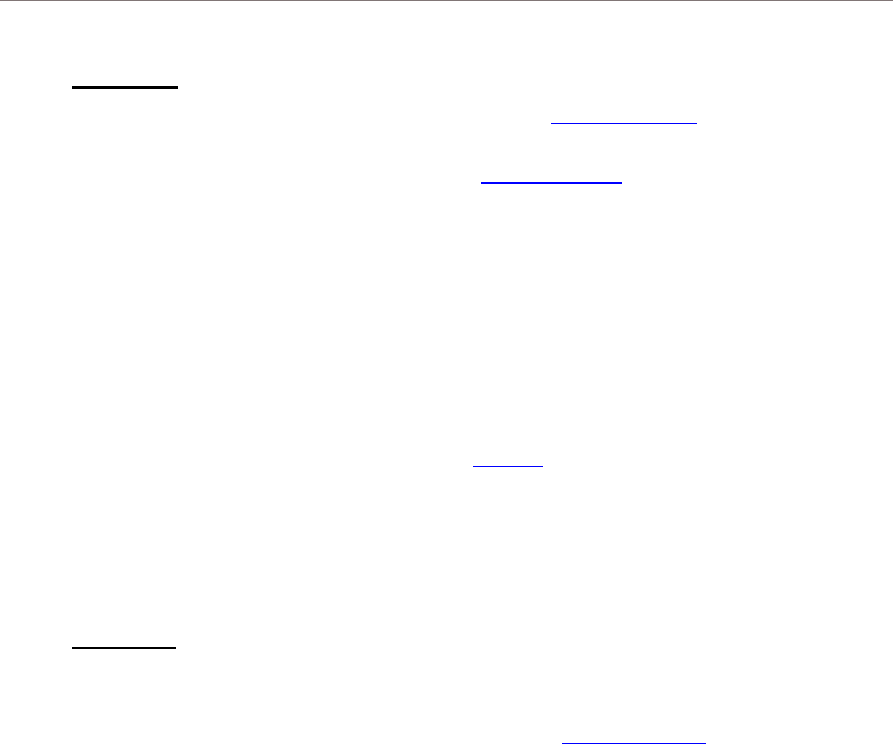

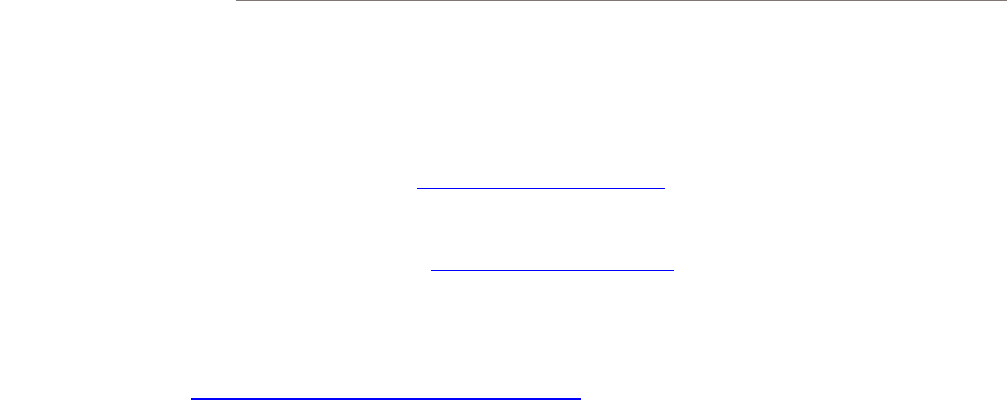

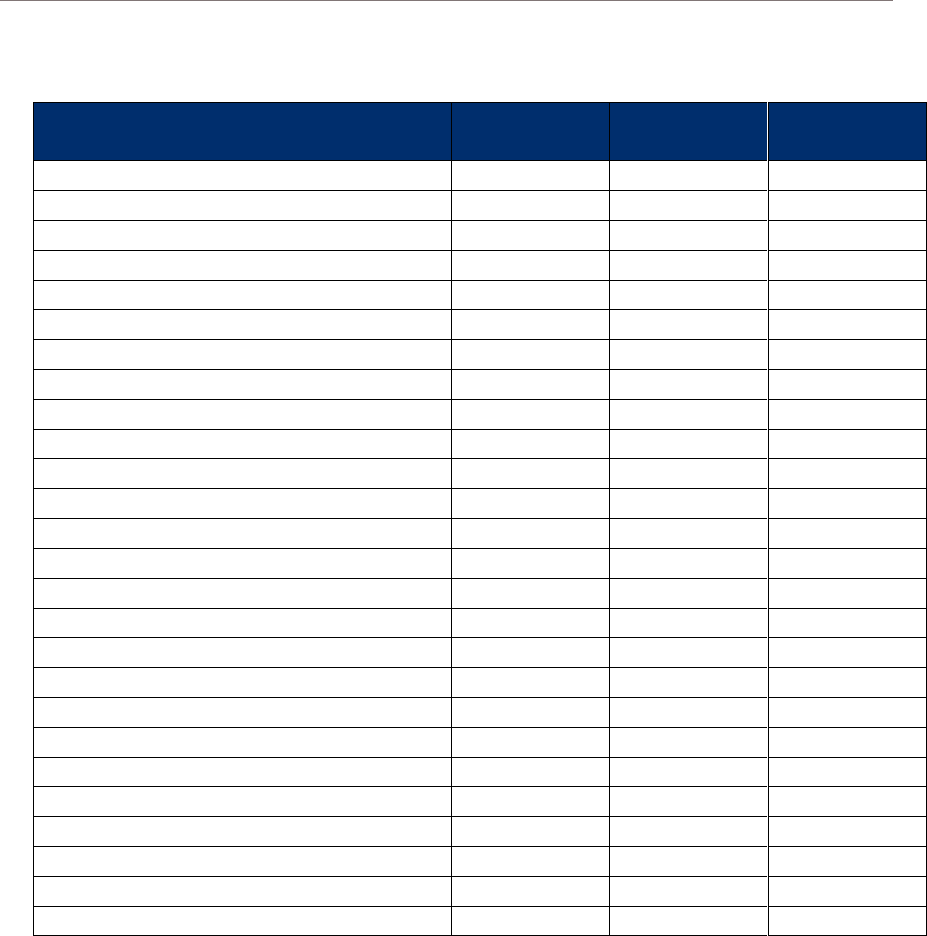

Massachusetts state-chartered credit unions experienced considerable growth in 2022 with total assets reaching $21.4

billion, an increase of 6.5% compared to year-end 2021. As operations returned to normal in the wake of the COVID-19

Pandemic, loan production resumed and saw a substantial increase of $2.2 billion, or 16.8%, over the same time period.

Loans were primarily funded through deposit growth of $432.1 million, or 2.5%. Total regulatory net worth increased by

$120.9 million, or 5.8%, to $2.2 billion and led to an aggregate net worth to total assets ratio of 10.3%. This slight decrease

from the year-end 2021 level of 10.4% was a result of asset growth outpacing net worth growth via earnings retention.

Net income for 2022 improved by an impressive 21.7% compared to 2021 results, and totaled $115.7 million as excess

liquidity, which was primarily held in cash and interest-bearing balances for the majority of 2021, was deployed into higher

yielding assets. That, coupled with several interest rate hikes throughout the year, led to the net interest margin increasing

from 2.17% to 2.47%. The provision for loan losses in 2022 totaled $10.7 million, which was a 17.2% decrease compared

to 2021 provisions of $12.9 million. The decreased provisions and delinquency rates are a testament to the strong asset

quality in the industry.

The aforementioned figures demonstrate Massachusetts state-chartered credit unions had another successful

year. Increased operating efficiency and stellar asset quality helped mitigate compressing margins due to funding cost

increases. Overall, the vast majority of state-chartered credit unions remain in fundamentally sound financial condition,

supported by robust total aggregate net worth levels and earnings performance across the industry.

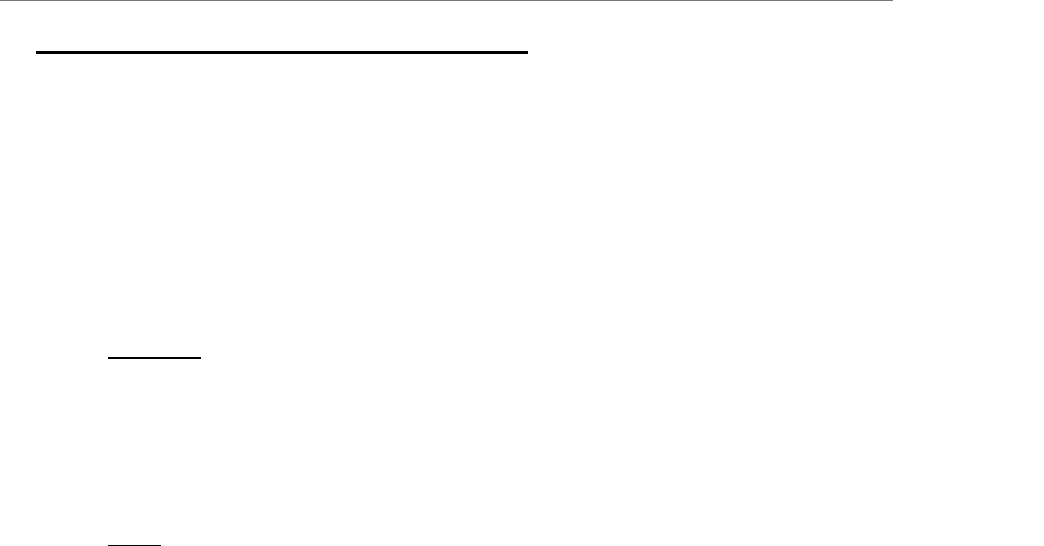

2018 2019 2020 2021 2022

Return on Average

Assets

0.59% 0.56% 0.36% 0.46% 0.56%

Net Interest Margin

2.78% 2.72% 2.41% 2.17% 2.47%

Net Worth to Total

Assets

11.31% 11.32% 10.46% 10.41% 10.34%

Delinquent Loans to

Total Loans

0.52% 0.56% 0.54% 0.34% 0.33%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

Financial Performance Metrics

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

$22,000

2018 2019 2020 2021 2022

Total Assets Net Loans and Leases

Total Shares and Deposits

Balance Sheet Trends (in millions)

2022 ANNUAL REPORT

25

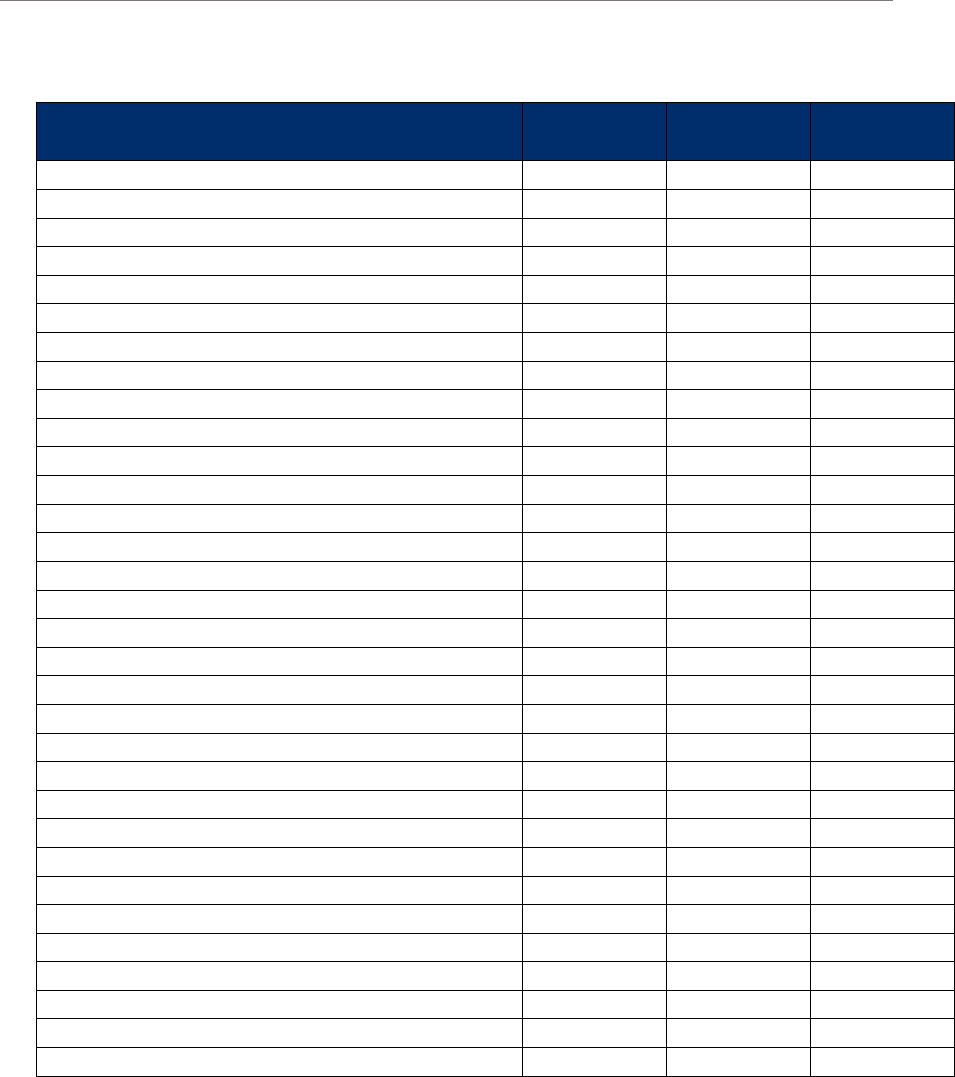

Credit Union Balance Sheet

Years ended December 31 2021 2022 % Change

$ in 000’s

$ in 000’s

Assets

Cash & Equivalents

1,731,561

1,313,842

-24%

Total Investments

4,411,409

3,779,281

-14%

Loans Held for Sale

26,858

7,801

-71%

Loans and Leases, Net of Unearned Income

13,235,189

15,475,541

17%

Allowance for Loan and Lease Losses

-80,952

-80,412

-1%

Net Loans and Leases

13,154,237

15,395,129

17%

Land and Building

208,883

232,705

11%

Other Fixed Assets

65,196

65,102

0%

NCUSIF Deposit

153,291

161,105

5%

Other Assets

350,061

450,490

29%

Total Assets

20,101,496

21,405,455

6%

Liabilities

Dividends Payable 135

604

347%

Other Borrowings 839,567

1,913,249

128%

Accounts Payable & Other Liabilties 177,221

218,028

23%

Total Shares & Deposits 17,046,143

17,478,264

3%

Total

Liabilities

18,063,066

19,610,145

9%

Equity

Undivided Earnings

1,919,983

2,034,734

6%

Equity Acquired in Merger

147,846

155,093

5%

Accumulated Unrealized Gain/(Loss) on AFS

-25,226

-390,898

1450%

Accumulated Unrealized Gain/(Loss) on CF Hedges

580

1,945

235%

Other Comprehensive Income

-4,753

-5,564

17%

Total Equity Capital

2,038,430

1,795,310

-

12%

Total Liabilities + Equity Capital

20,101,496

21,405,455

6%

MASSACHUSETTS DIVISION OF BANKS

26

Credit Union Income Statement

Years ended December 31 2021 2022 % Change

$ in 000’s

$ in 000’s

Total Interest Income

530,689

608,365

15%

Total Interest Expense

85,003

94,860

12%

Net Interest Income

445,686

513,505

15%

Provision for Loan and Lease Losses (PLLL)

12,956

10,729

-17%

Net Interest Income after PLLL

432,730

502,776

16%

Fee Income

62,703

68,338

9%

Other Income

92,052

71,411

-22%

Gain/(Loss) on Equity Securities

6,055

-

6,018

-

199%

Gain/(Loss) on Other Securities

2,532

-

124

-

105%

Other Gain/(Loss) Sales

0

230

Gain/(Loss) on Disposition of Fixed Assets

-123

670

-645%

Other Non

-

interest Income/(Expense)

3,912

5,191

33%

Total Non

-

Interest Income

167,131

139,698

-

16%

Employee Compensation and Benefits

262,448

268,510

2%

Travel and Conference Expense

2,817

4,204

49%

Office Occupancy Expense

40,809

43,177

6%

Office Operation Expense

88,912

92,834

4%

Education and Promotional Expense

16,785

18,584

11%

Loan Servicing Expense

20,413

20,268

-

1%

Professional and Outside Services

52,741

59,374

13%

Member Insurance-Other

3,480

3,090

-

11%

Operating Fees

2,201

2,574

17%

Miscellaneous Operating Expenses

14,162

14,148

0%

Total Non-Interest Expense

504,768

526,763

4%

Net Income (Loss)

95,093

115,711

22%

2022 ANNUAL REPORT

27

Consumer Protection and

Outreach

The Consumer Protection examination unit has been at the forefront of important consumer protection regulatory issues

throughout the year. In 2022, working closely with our federal counterparts, the unit continued to review banking practices

associated with deposit accounts and assessment of fees as a targeted consumer protection risk area. In October 2022, the

agency issued the updates to its Regulatory Bulletins in response to the implementation of Chapter 338 of the Acts of 2020,

An Act Modernizing the Credit Union Laws (Credit Union Modernization). Regulatory Bulletin 2.1-106 was updated to clarify

additional provisions to the Guidelines for “18-65” which now prohibit both banks and credit unions from imposing any fee,

charge or other assessment against the savings account or demand deposit account of any persons 65 years of age or older

or 18 years of age or younger. The unit also collaborated on the amendment of Regulatory Bulletin 1.3-104, Counseling And

Opt-In Requirements For Subprime Adjustable Rate Mortgage Loans Made To First Time Home Loan Borrowers. The

amendment now clarifies the use of APOR values published by the Consumer Financial Protection Bureau to arrive at the

annual percentage rate.

Also in 2022, Deputy Commissioner of Consumer Protection Rivera, directed and moderated four DOB connects webcasts,

including: A Discussion About Fair Banking and Verifying Compliance with Regulation E, Home Mortgage Disclosure Act

(HMDA): Top Regulatory Findings and Best Practices from State Examiners, 2022: Compliance Priorities: Concerns and

Perspectives from the Financial Industry, and Cannabis and BSA: Banking Perspectives & Regulatory Considerations. These

various themes were discussed by panelists from the financial industry and often supplemented with examination information

from bank examiners. We were joined by over 800 attendees.

MASSACHUSETTS DIVISION OF BANKS

28

Consumer Assistance and

Enforcement and Investigation

During 2022, the Consumer Assistance Unit (CAU) made changes to its website to make it more user friendly. CAU also

made changes to its internal systems and procedures for Foreclosure Delay Requests (FDRs) to make the process more

streamlined. The Unit closely monitored COVID-related consumer protection measures, including the rollout of the

Homeowner Assistance Fund (HAF) Program, to ensure that Massachusetts consumers received correct and timely

information.

The Consumer Assistance Unit fielded 4,776 calls and received 257 written consumer complaints in 2022. A total of 255

complaints were resolved and 45 consumer reimbursements were obtained for a total of $301,580.00 reimbursed to

consumers. The Unit received 132 requests for foreclosure relief, and long-term stays were granted for 76 of the requests.

Since the foreclosure relief program was instituted in 2007, 7,810 request have been received and 3,909 foreclosure stays

have been granted.

2022 ANNUAL REPORT

29

Foreclosure Prevention Grant

Initiative

Since the inception of the foreclosure prevention counseling and education grant initiative in 2008, the Division has awarded

over $24 million to nonprofits with a focus on consumer counseling and education services pursuant to Chapter 206 of the

Acts of 2007, An Act Protecting and Preserving Homeownership. These organizations have been able to assist over 90,000

consumers. Funding for this initiative is possible through administrative fees associated with the licensure of loan originators

according to M.G.L. c. 255F.

On March 15, 2022, the Division of Banks awarded over $2.5 million in Chapter 206 grants to fund first-time homeownership

education programs and foreclosure prevention counseling centers throughout the Commonwealth. These funds went to a

total of 24 organizations including 9 regional foreclosure prevention centers and 15 consumer counseling organizations.

The grants assist homeowners who are experiencing some type of financial hardship caused by either a loss of or reduction

in income or a medical issue as well as prospective homebuyers who are determining if homeownership is right for them.

Awarded organizations offer programs including, but not limited to, foreclosure prevention counseling services, loan

modification assistance, first-time homeownership education, or counseling for non-traditional or high-cost loans such as

subprime products. During the pandemic emergency, these organization pivoted to offering their services and programs

through online platforms, committed to offering guidance to prospective home buyers and a lifeline to those struggling with

home retention.

MASSACHUSETTS DIVISION OF BANKS

30

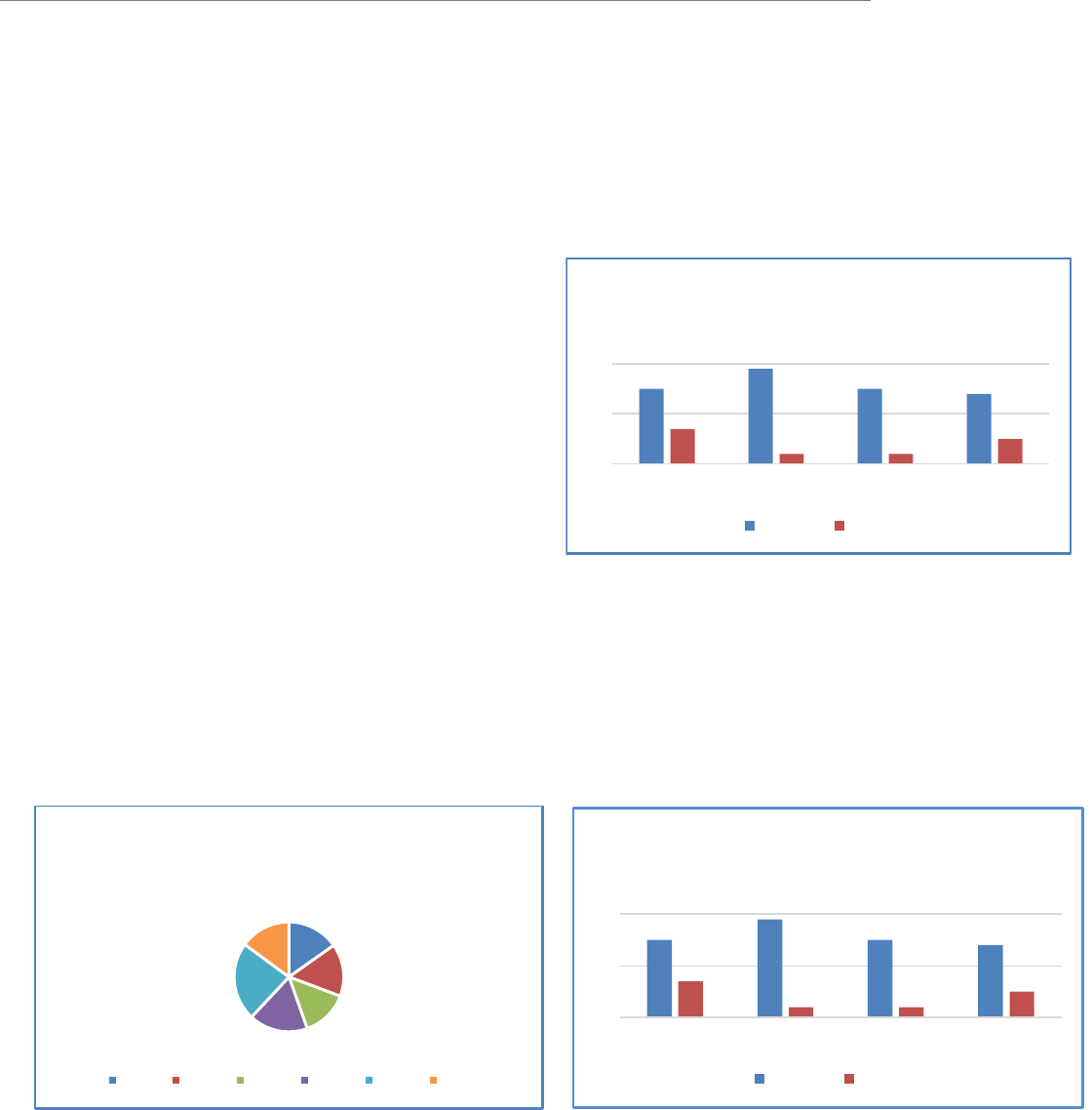

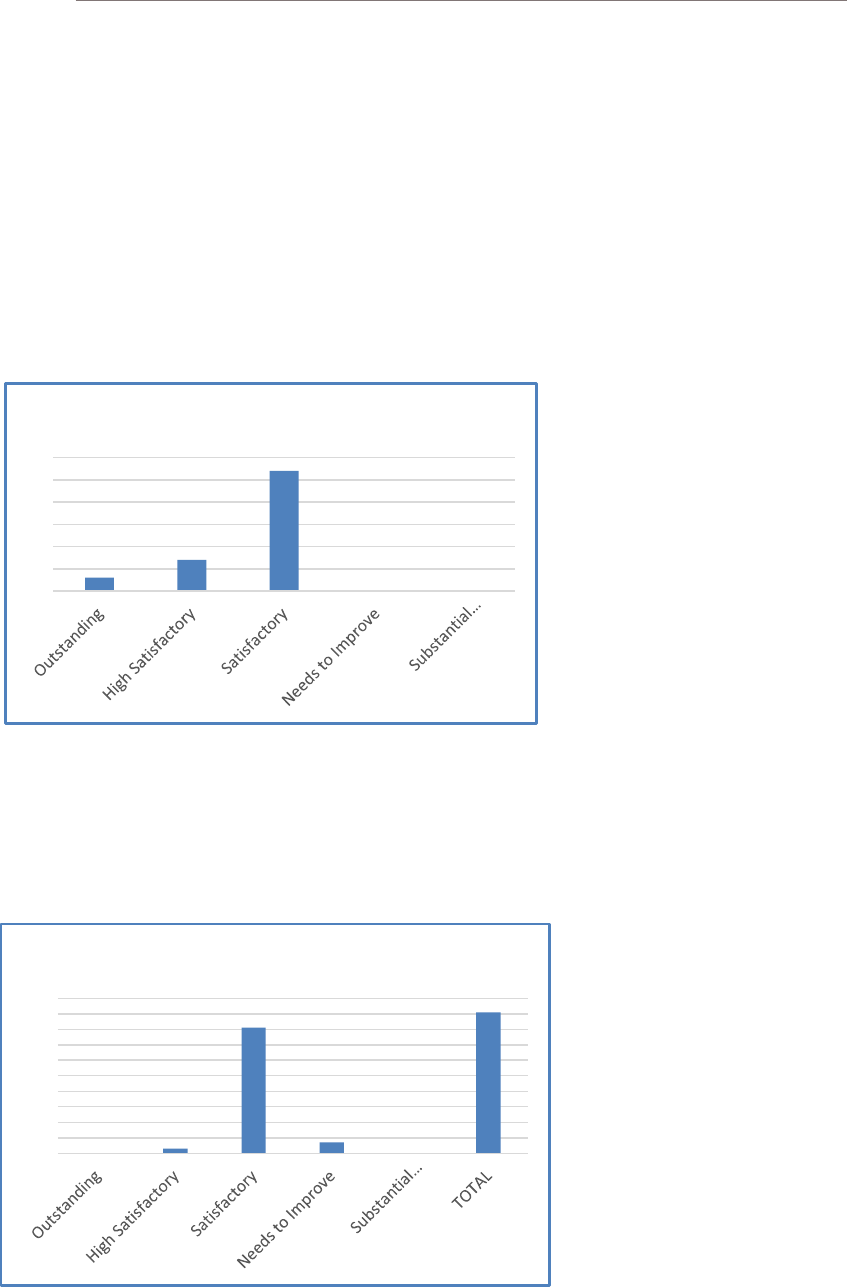

Community Reinvestment Act

Under the Massachusetts Community Reinvestment Act (CRA), the Division examines state-chartered banks and credit

unions to assess each institution’s record of meeting the needs of its entire assessment area, including low-and moderate-

income neighborhoods, consistent with the safe and sound operation of the institution. CRA requirements are also in place

for certain mortgage lenders in accordance with M.G.L. c. 255E, § 8. These provisions require a CRA evaluation of mortgage

lenders that have originated 50 or more Home Mortgage Disclosure Act (HMDA) reportable mortgage loans in the previous

two calendar years. Upon conclusion of a CRA examination, the Division prepares a written Public Evaluation which can

be obtained on the Division’s website or directly through the institution.

The Division conducted 37 CRA examinations of banks and credit unions during 2022. There are currently 141 Public

Evaluations of banks and credit unions posted on the Division’s website.

The Division conducted 20 CRA examinations of mortgage lenders during the 2022. There are currently 91 Public

Evaluations of mortgage lenders posted on the Division’s website.

0

3

81

7

0

91

0

10

20

30

40

50

60

70

80

90

100

Mortgage Lender CRA Ratings

3

7

27

0 0

0

5

10

15

20

25

30

Bank & Credit Union CRA Ratings

2022 ANNUAL REPORT

31

Cyber/IT/Fintech

Cyber threats remain a menace to the safety and soundness of our supervised institutions and society at large. The

Division’s Cyber/IT/Fintech Unit continues to work directly with the financial industry to help strengthen the resilience and

security of the financial sector as well as the confidentiality and integrity of Massachusetts residents’ financial

information. This work includes continuous collaboration with other state and federal bank regulators, and numerous cyber

threat exchange groups that monitor local, national, and global threats. Massachusetts is not an island when it comes to

exposure to cyber threats and maintaining these relationships is paramount to ensuring continued vigilance and

awareness. Maintaining an appropriate level of vigilance and awareness also involves continuous training of Division

staff. To address the growing threat environment, the Cyber/IT/Fintech Unit continues to work to expand and update

examination procedures for non-depository institutions and to evaluate risks posed by third parties, especially managed

service providers (MSPs).

Ransomware also continues to present a major threat to Massachusetts consumers, businesses, and the financial

industry. Bad actors continue to routinely steal confidential information in advance of deploying ransomware. In more

recent attacks, bad actors have chosen to bypass the deployment of ransomware and instead extort victims with the release

of stolen data if payment demands are not met. The Division has engaged in ransomware-related outreach initiatives and

focused a great deal of effort around the Conference of State Bank Supervisors (CSBS) Ransomware Self-Assessment

Tool (RSAT). Our agency collaborated with a task force of bankers from across the U.S., other state financial regulators,

and the United States Secret Service to develop the Ransomware Self-Assessment Tool. This tool helps institutions identify

and close gaps in their IT environment. In recognition of the changing threat landscape and evolutions in institution controls

since its original release, the Division continues to work with these groups to update and enhance the RSAT, a revised

version of which is expected to be released later in 2023.

Unfortunately, cybercrime is a lucrative, global industry; threats arising from bad actors against the financial sector can be

expected for the foreseeable future. The agency’s Cyber/IT/Fintech Unit continues to monitor the direction of these threats

and to address the mitigation of cyber and IT risks to our supervised institutions and the customers they serve.

MASSACHUSETTS DIVISION OF BANKS

32

Legal Unit

The Legal Unit provides legal advice and representation to the Commissioner of Banks and Division. Representation and

advice is given on matters related to the regulation of the Division’s supervised financial institutions and licensees. The

Legal Unit drafts and coordinates all legislative and regulatory filings on behalf of the Division of Banks.

The Legal Unit reviews and responds to:

Applications submitted by regulated financial institutions

Requests for regulatory approvals submitted by regulated entities or attorneys

Requests for regulatory opinions submitted by regulated entities or attorneys

2022 ANNUAL REPORT

33

Major Depository Corporate

Transactions

There were 16 major corporate transactions consummated in 2022.

Nine transactions involved mergers which resulted in the reduction of one savings bank, one

co-operative bank, one trust company, and two credit unions.

Two savings banks completed reorganizations into a mutual holding company structure. One

other savings bank was approved in 2022 to reorganize into the mutual holding company

structure in a transaction with an effective date of January 1, 2023.

Three savings banks converted to trust companies by operation of law.

One mutual co-operative bank converted to a stock co-operative bank.

A co-operative bank purchased certain assets and assumed certain liabilities of a trust

company.

Bank Transactions

In 2022, there were four bank merger transactions, three of which reduced the number of Massachusetts state-chartered

banks and three savings banks converted by operation of law to trust companies. At year end, there were 43 savings banks,

32 co-operative banks, 16 trust companies, and 2 limited purpose trust companies.

Mergers

Envision Bank, Randolph merged with and into Abington Bank, Abington effective October 7, 2022.

Foxboro Federal Savings, Foxboro merged with and into Norwood Co-operative Bank, Norwood effective

December 12, 2022.

1

Northmark Bank, North Andover merged with and into Cambridge Trust Company, Cambridge effective

October 1, 2022.

Patriot Community Bank, Woburn merged with and into East Cambridge Savings Bank, Cambridge,

effective July 31, 2022.

Reorganization into Mutual Holding Company Structure

Adams Community Bank, Adams reorganized into a mutual holding company structure, Community

Bancorp of the Berkshires, MHC, with a mid-tier holding company, Community Bancorp of the Berkshires,

Inc., effective January 1, 2022.

North Brookfield Savings Bank, North Brookfield reorganized into a mutual holding company structure,

TruNorth Bancorp, with a mid-tier holding company, TruNorth Bancorp, Inc. effective January 1, 2022.

Institution for Savings in Newburyport and its Vicinity, Newburyport was approved to reorganize into a

mutual holding company structure, IFS 1820 Bancorp, MHC on December 15, 2022. The reorganization

was completed with an effective date of January 1, 2023.

2

1

Norwood Co-operative Bank changed its name to OneLocal Bank effective April 24, 2023.

2

Due to an effective date occurring on January 1, 2023, the mutual holding company reorganization for Institution for Savings in Newburyport and its

Vicinity was excluded from the number of major corporate transactions reported for the 2022 calendar year and therefore is being included in the number

of corporate transactions reported for 2023.

MASSACHUSETTS DIVISION OF BANKS

34

Conversion to Trust Company by Operation of Law

Middlesex Savings Bank, Natick converted from a Massachusetts state-chartered savings bank to a

Massachusetts state-chartered trust company by operation of law effective March 1, 2022. The Bank

continues to operate as Middlesex Savings Bank and remains in a mutual holding company structure as a

wholly owned subsidiary of Middlesex Bancorp, MHC.

Salem Five Cents Savings Bank, Salem converted from a Massachusetts state-chartered savings bank to

a Massachusetts state-chartered trust company by operation of law effective September 30, 2022. The

Bank continues to operate as Salem Five Cents Savings Bank and remains in a mutual holding company

structure as a wholly owned subsidiary of Salem Five Bancorp.

The Cape Cod Five Cents Savings Bank, Hyannis, converted from a Massachusetts state-chartered

savings bank to a Massachusetts state-chartered trust company by operation of law effective December

16, 2022. The Bank continues to operate as The Cape Cod Five Cents Savings Bank and remains in a

mutual holding company structure as a wholly owned subsidiary of Cape Cod Five Mutual Company.

3

Mutual Bank Conversion to a Stock Bank

Everett Co-operative Bank, Everett converted from a mutual bank to a stock bank effective July 27, 2022.

The stock bank is a wholly owned subsidiary of ECB Bancorp, Inc., a stock holding company that was

established in connection with Everett Co-operative Bank’s conversion to stock form.

Bank Holding Company Acquisition

Brookline Bancorp, Inc., Boston acquired PCSB Financial Corporation, Yorktown Heights, New York, the

holding company for PCSB Bank, Brewster, New York effective 1/1/23.

4

Brookline Bancorp, Inc. is the

holding company for Brookline Bank, Brookline, Massachusetts; Bank Rhode Island, Providence, Rhode

Island; and PCSB Bank, Brewster, New York.

Purchase and Assumption

Needham Bank, Needham purchased certain assets and assumed certain liabilities which related primarily

to the deposits of cannabis-related business and money service business customers of Eastern Bank, Boston,

Massachusetts on April 1, 2022.

Name Change

The Provident Bank, Amesbury changed its name to BankProv effective August 16, 2022.

3

Cape Cod Five Mutual Company changed its name to Mutual Bancorp on June 7, 2023.

4

Due to an effective date occurring on January 1, 2023, this bank holding company acquisition was excluded from the number of major corporate

transactions reported for the 2022 calendar year and therefore is being included in the number of corporate transactions reported for 2023.

2022 ANNUAL REPORT

35

Credit Union Transactions

There were five credit union mergers, two of which reduced the number of Massachusetts state-chartered credit unions

form 53 to 51 during the year. Two Massachusetts state-chartered credit unions merged with and into other Massachusetts

state-chartered credit unions. Three federally chartered credit unions merged with and into Massachusetts state-chartered

credit unions.

Mergers

Holyoke Postal Credit Union, Holyoke merged with and into Holyoke Credit Union, Holyoke effective